URD 2022

-

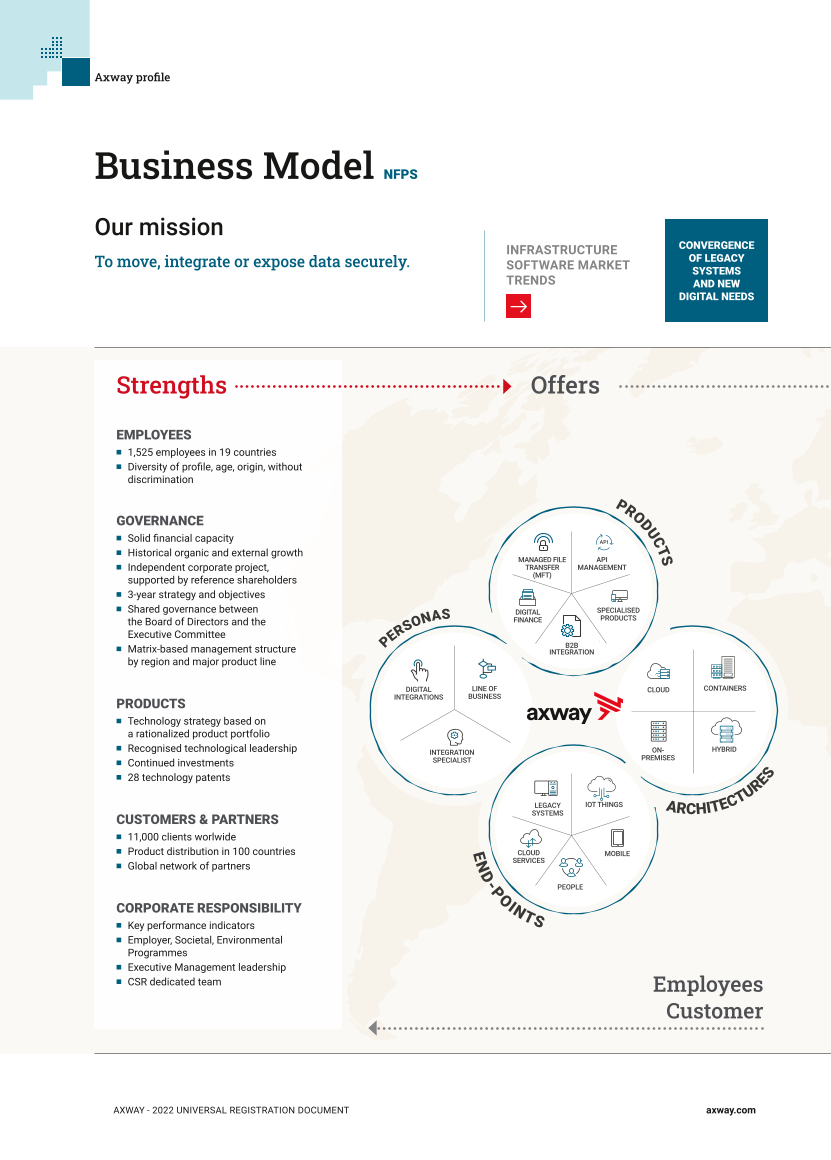

Axway and its business activities

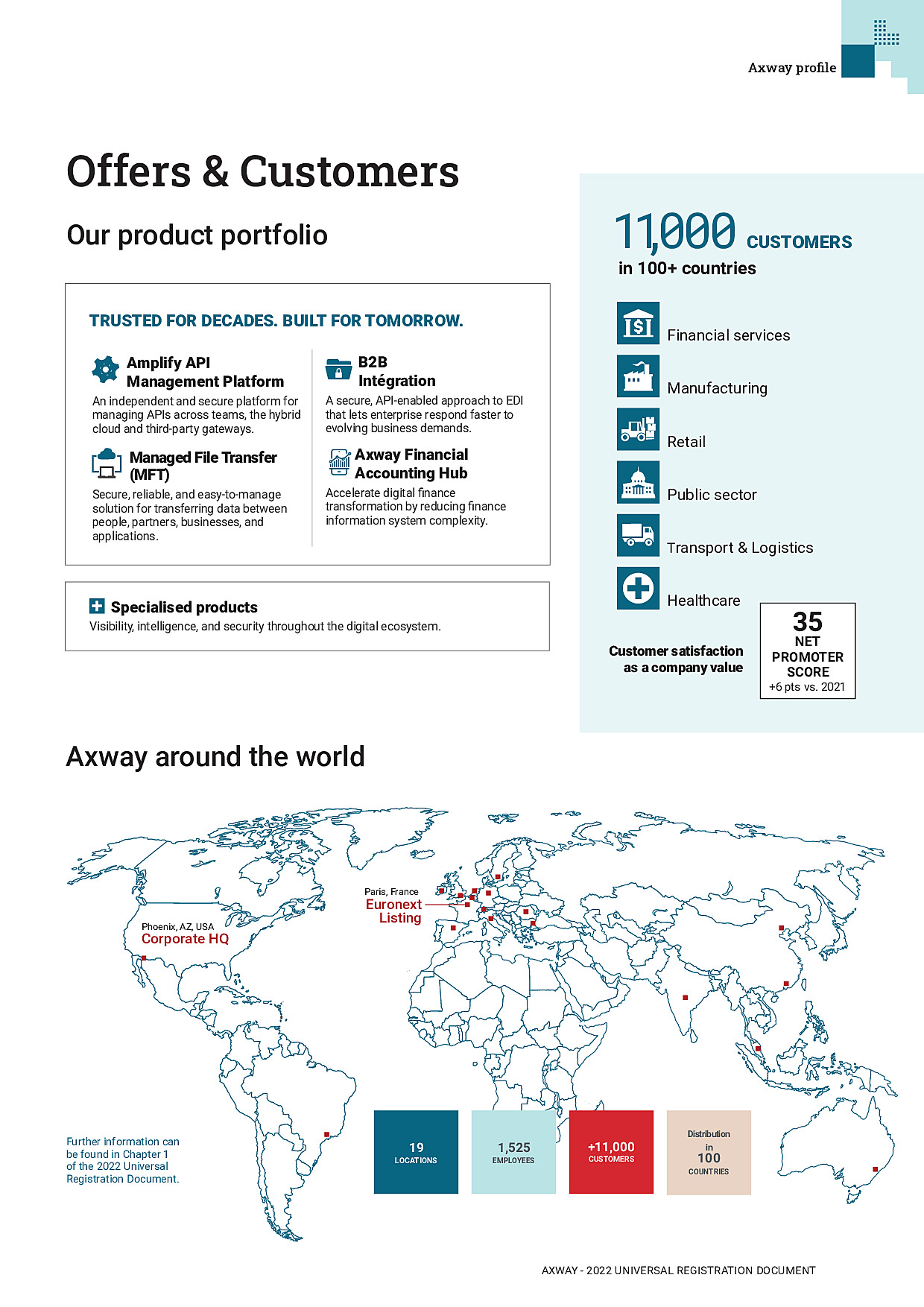

This Chapter presents Axway’s history, activities, markets and business strategy. By combining more than 20 years of experience with a continuous investment strategy, Axway today offers one of the most comprehensive portfolios of software solutions on the market in the field of data flow management. Leveraging technologies such as APIs, MFT, B2B integration and Financial Accounting Hub, Axway enables its 11,000 customers worldwide to securely transfer, integrate or expose their data. With 1,525 employees in 19 countries, Axway helps large enterprises modernise their IT infrastructures to create simple, seamless digital experiences that bring value to their entire ecosystem.

-

1.1Axway’s history

2001-2010: Axway, the software subsidiary of Sopra group

Spin-off and European development

Axway’s journey began in January 2001 when the infrastructure software business of IT services group Sopra (now Sopra Steria) was spun off as a subsidiary. Sopra’s different infrastructure solutions, including notably the Règles du Jeu accounting interpretation software and the CFT and InterPel file transfer tools, were then grouped together within a single entity: Axway.

In the following four years, Axway accelerated its international development and began its external growth with the acquisition of Viewlocity (2002). Between 2001 and 2005, these developments enabled Axway to take up a position in most major European markets and doubled its customer numbers to 6,000.

North American expansion and market leadership

Axway launched its expansion into North America in 2005, with the ambition of becoming a world leader in several sub-segments of the infrastructure software market and particularly the Managed File Transfer (MFT) and Business-to-Business integration (B2B) fields.

At the time, the US represented over 50% of the addressable market, but Axway generated only 4% of its revenue in the country. The Company then undertook strategic acquisitions, such as Cyclone Commerce in 2006, and rapidly aligned its geographic presence with the reality of its markets while establishing its executive management in the US.

-

1.2Overview of Axway’s markets

1.2.1Axway in the infrastructure software market

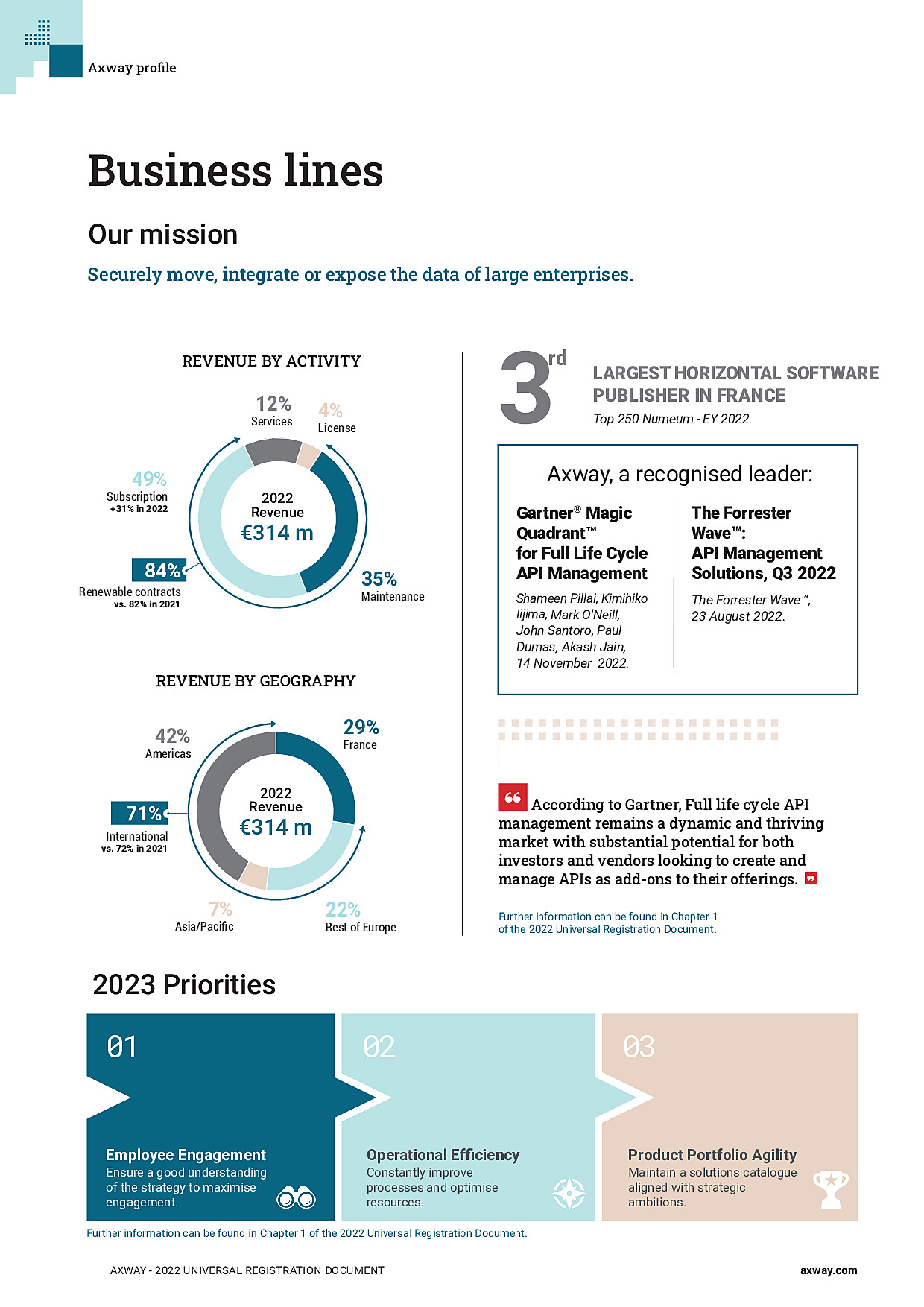

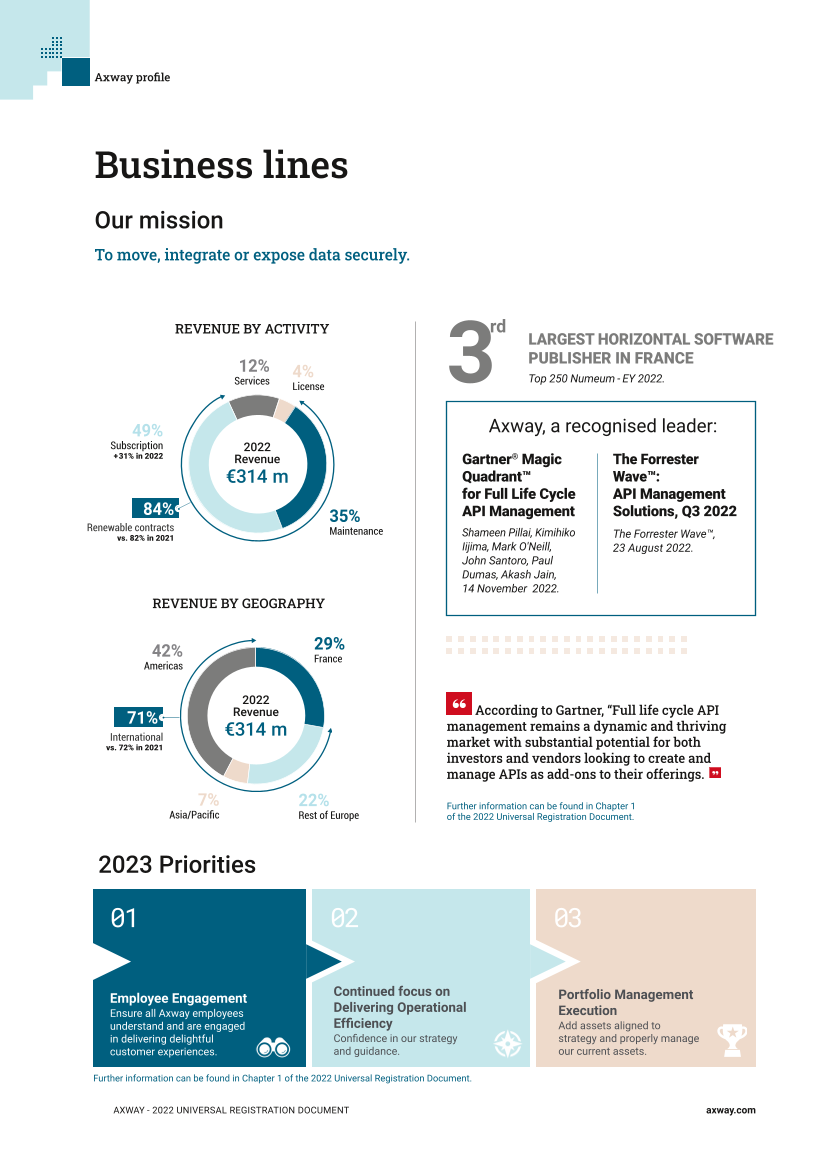

With revenue of €314.0 million in 2022, Axway is France’s 3rd largest horizontal software publisher.(1)

According to Gartner, “Enterprise infrastructure software spending is expected to grow at a compound annual growth rate (CAGR) of 12.3% (in constant US dollars) between 2021 and 2026 and reach $623 billion in current US dollars by 2026.”(2)

As a software publisher, Axway operates in several infrastructure software sub-segments and specifically application infrastructure and middleware (AIM). In total, Gartner estimates the application infrastructure and middleware sub-segment market at US$56.6 billion in 2023.(2)

Within the application infrastructure and middleware sub-segment, Axway participates in four specific markets:

- ●API Management;

- ●Managed File Transfer (MFT);

- ●B2B Gateway Software (B2B Integration);

- ●Integration Platform as a Service (iPaaS).

For 2023, Gartner estimates growth in the different technology markets in which Axway operates as follows: Full Life Cycle API Management +19.0%, Integration Platform as a Service (iPaaS) +24.7%, Managed File Transfer Suites +2.1%, B2B Gateway Software (Stand-Alone) -2.1%(2).

As an international player, Axway is exposed to the dynamics of different geographic markets. The Company has locations in 18 countries across five continents. Gartner estimates 2023 application infrastructure and middleware growth in Axway regions as follows: North America +12.3%, Latin America +13.1%, Western Europe +9.8% and Asia/Pacific +12.1%.(2)

Supported by a large network of technology partners and dealers, this multi-local presence means that Axway solutions are used in over 100 countries. The Company can support the largest organisations with all their transnational projects.

Infrastructure software is used in cloud, hybrid and on-premise environments. Historically, Axway distributes its solutions in the form of on-premise perpetual licenses. Since 2015, the Company has also offered most of its solutions through “as a service” Subscription contracts. To be able to provide these Subscription offerings, Axway makes use of cloud and/or hybrid technology models.

- ●requirements are constantly increasing, both with regard to the availability of information on all devices and the security of connections and data. IT ecosystems continue to develop as more and more companies work together through collaborative solutions;

- ●while more and more workloads are moving to the cloud, companies have decades of heritage infrastructure and systems that must continue to be leveraged to meet short-term needs and cost constraints.

Companies are therefore naturally turning to integration platforms to facilitate their digital transformation.

According to Gartner, “full life cycle API management remains a dynamic and thriving market with substantial potential for both investors and vendors looking to create and manage APIs as add-ons to their offerings. Gartner expects this market to continue its strong double-digit growth for at least the next five years."(3)

Axway’s hybrid integration offering, based on its Amplify API Management Platform solution, is recognised globally as a leader in the industry. In the third quarter of 2022, Axway was positioned as a Leader in The Forrester WaveTM: API Management Solutions, Q3 2022.(4) It was also recognised as a Leader in the November 2022 Gartner® Magic Quadrant™ for Full Life Cycle API Management for the seventh time.(1)(3) Axway aims to maintain its position as a leader in this market and continues to invest in this direction.

-

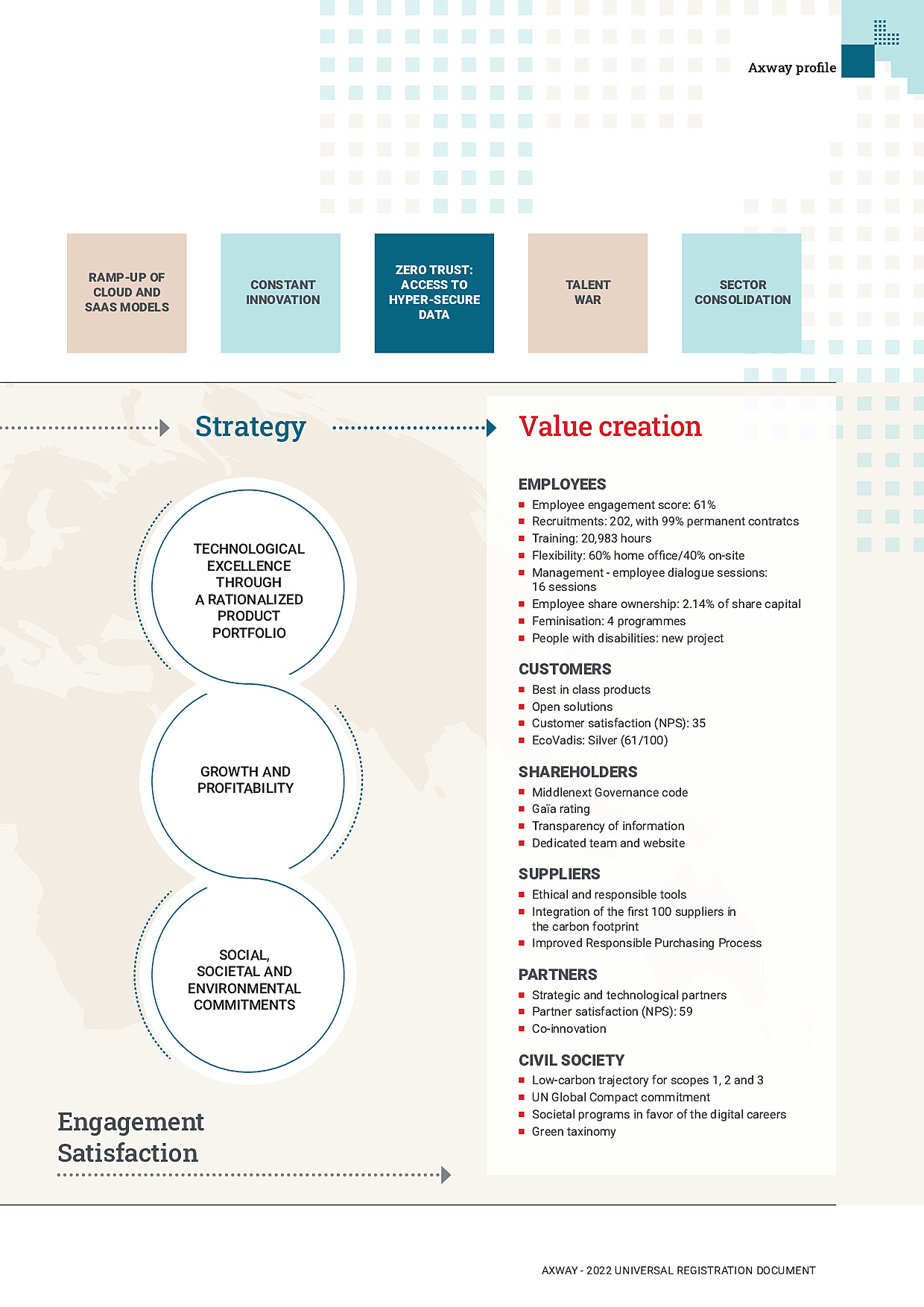

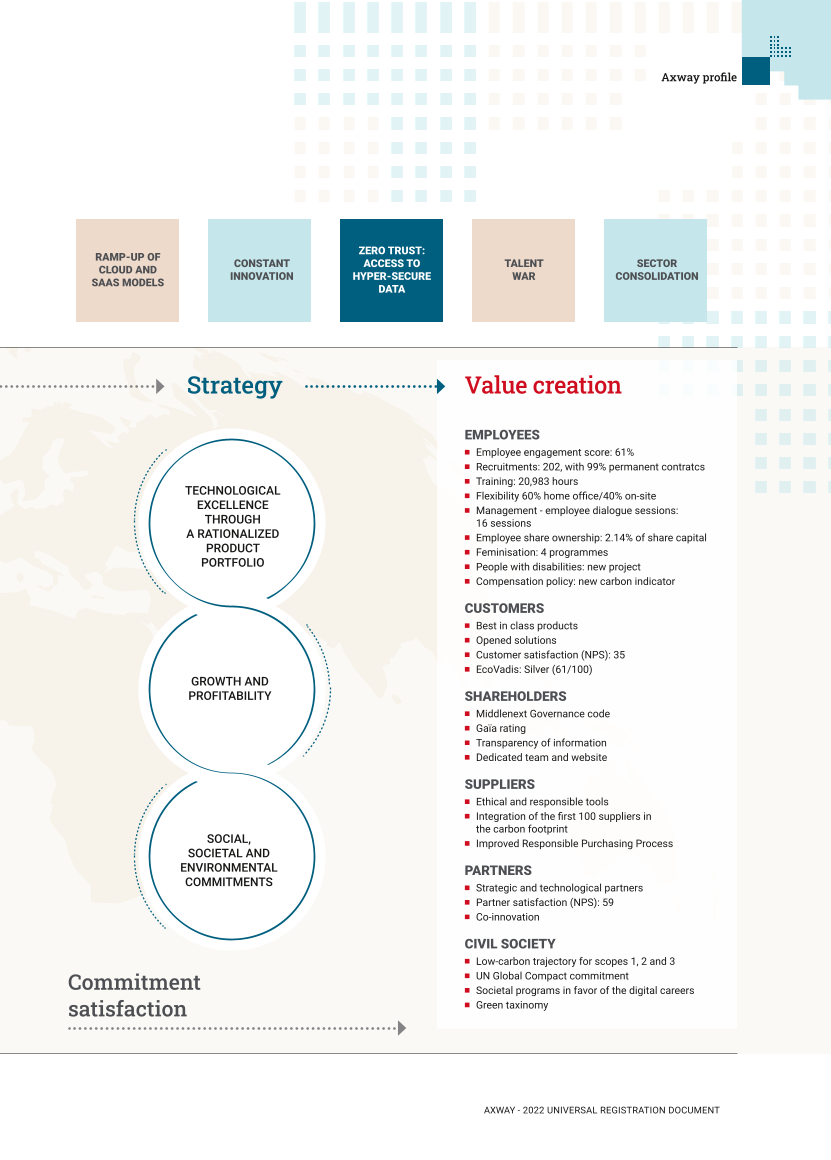

1.3Strategy and objectives AFR

1.3.1Axway’s strategy

As a software publisher and a leader in digital transformation and B2B integration, Axway supports the modernisation of its customers’ IT infrastructures by securely moving, integrating or exposing their strategic data.

Axway’s different technological areas of expertise converge to connect people, devices, companies and stakeholder ecosystems, thanks to software solutions which are turning customers’ heritage infrastructure into brilliant digital experiences which create value for each use case.

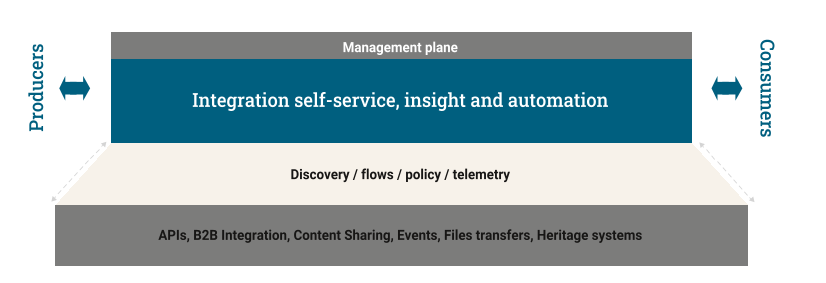

The Amplify platform, powered by APIs, brings together all the players in a major organisation’s IT ecosystem around a common set of tools. The teams in charge of applications and their integration, developers, operators, architects or members of the Board of Directors, within the company or with one of its partners, use Amplify to make the use of data a competitive advantage.

Through a range of ready-to-use solutions and services, Axway’s expertise is demonstrated in the following areas:

- ●API Management: Amplify combines API management functionalities and microservices governance to streamline the management, analysis and expansion of digital services;

- ●Application Integration: Amplify provides access to a collection of pre-built integration scenarios via IPaaS capacities;

- ●Managed File Transfer (MFT): flexible and secure management of the largest critical data flows;

- ●B2B integration: orchestration of business interactions across all value chains within the company.

Axway Open Everything

The Amplify ecosystem

The Amplify platform, powered by APIs, is able to evolve the existing infrastructure solutions of major organisations, and accommodates cloud, hybrid and on-premise architectures. It is distributed as a Subscription or as a License to respond to the challenges of all types of customers.

In addition to the technological functionalities described previously, the Amplify platform offers various high added-value outcomes:

- ●agility: single control plane to manage all vendor gateways in the ecosystem providing automated visibility and traceability of transaction flows;

- ●flexibility: hands-free visibility and governance, integration with Axway and non-Axway infrastructure and gateways;

- ●efficiency: automation that allows the management and maintenance of the integrity of the catalogue and elimination of long manual interventions;

- ●risk reduction: secure open event-based platform enabling processes to be automated and integrated with existing processes, creating productive governance that accelerates business.

Its ramp-up will enable Axway to continue to develop its activities towards Subscription-based offerings through a growing, profitable business model that offers good medium-term visibility.

Intellectual property and Patents

At 31 December 2022, Axway had 28 patents (Issued and/or Published) relating to its technologies and solutions. These patents are filed mainly in the United States, in the security and exchange integrity market segment. The Company’s business as a whole is not specifically dependent on a particular patent or technology.

-

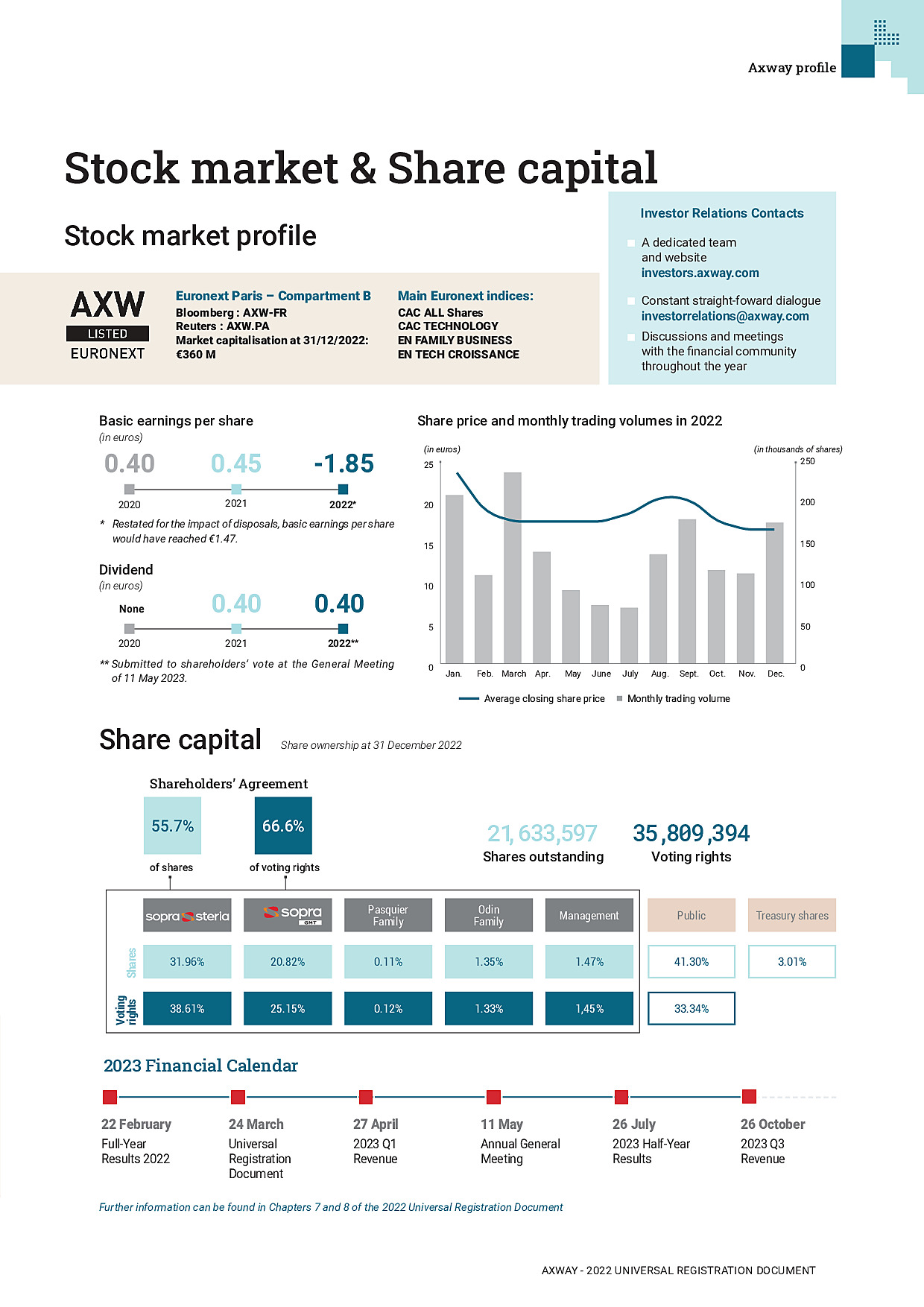

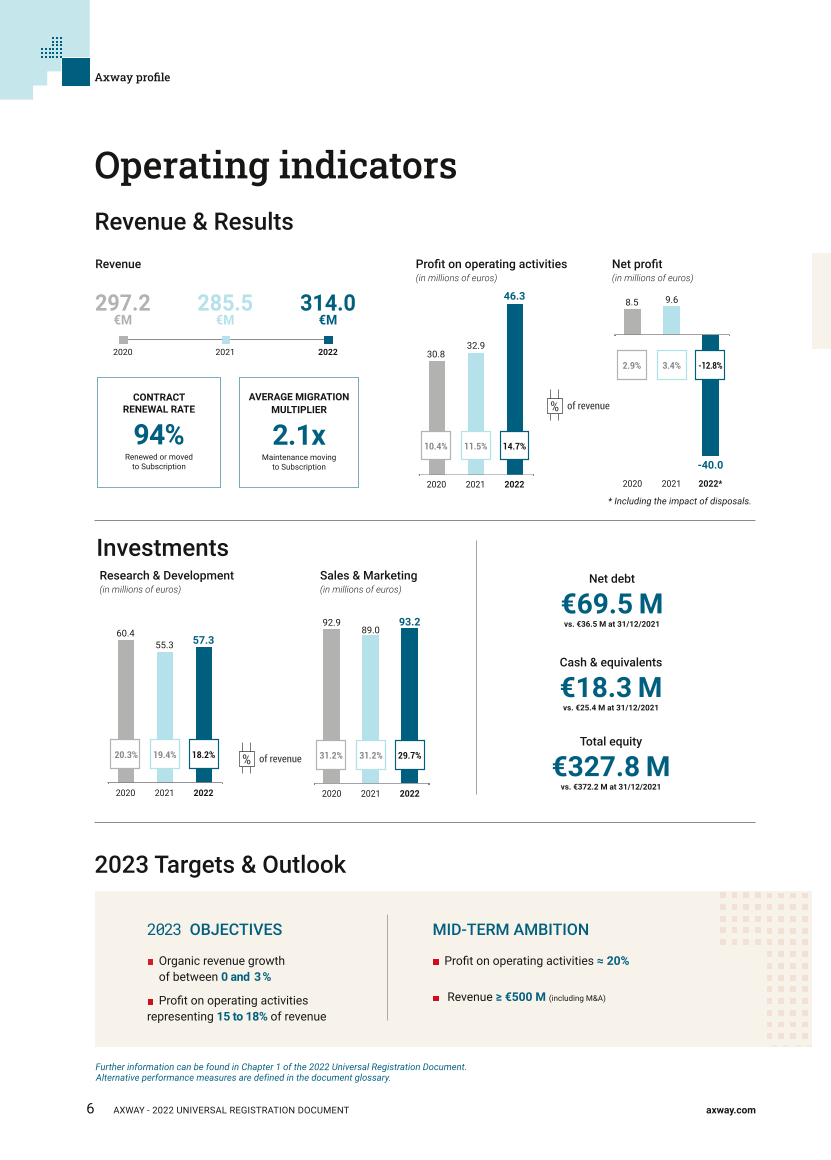

1.4 Key figures and comments on the 2022 consolidated financial statements

1.4.1 Key figures

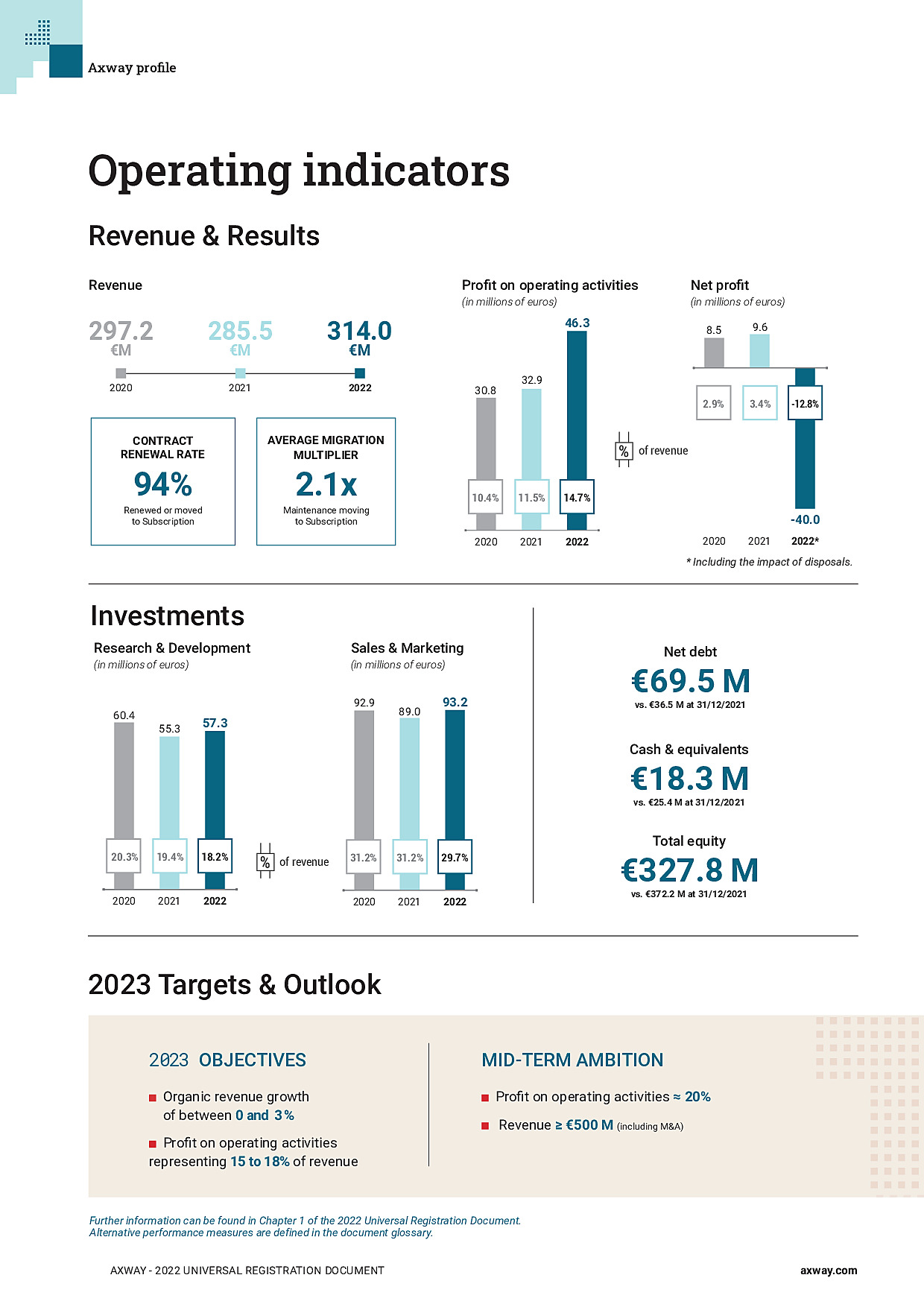

(in millions of euros)

2022

2021

2020

Revenue

314.0

285.5

297.2

EBITDA

56.3

41.3

43.7

Profit on operating activities

46.3

32.9

30.8

As a % of revenue

14.7%

11.5%

10.4%

Profit from recurring operations

37.4

19.9

17.6

As a % of revenue

11.9%

7.0%

5.9%

Operating profit

-46.4

17.3

17.6

As a % of revenue

-14.8%

6.1%

5.9 %

Net profit – Group share

-40.0

9.6

8.5

As a % of revenue

-12.7%

3.4%

2.9

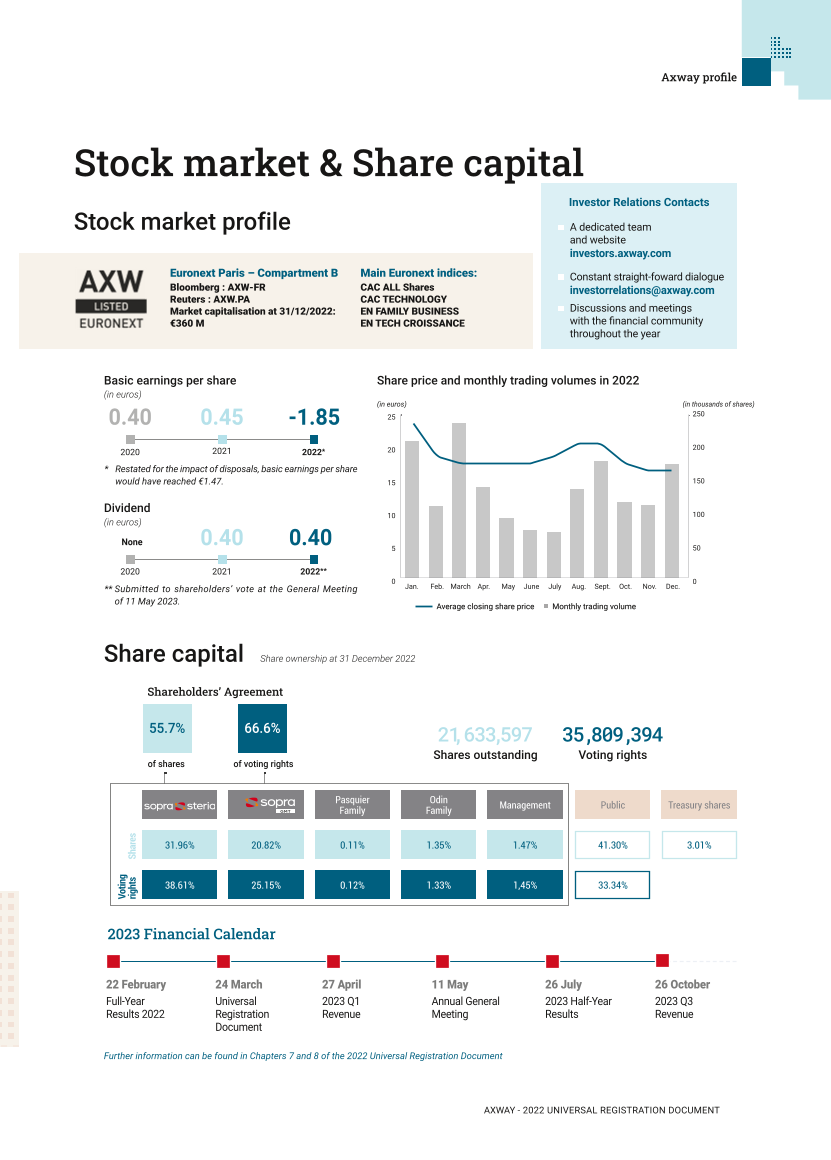

Number of shares at 31 December

21,633,597

21,633,597

21,351,066

Basic earnings per share (in euros)

-1.85

0.45

0.40

Diluted earnings per share (in euros)

-1.85

0.43

0.38

Net dividend per share* (in euros)

0.40

0.40

0.40

Cash and cash equivalents

18.3

25.4

16.2

Total assets

571.1

582.9

559.3

Total non-current assets

374.0

424.6

422.9

Deferred income (current)

55.6

55.8

54.7

Shareholders’ equity – Group share

327.8

372.2

355.5

Net debt (cash)

69.5

36.5

24.0

Employees at 31 December

1,525

1,712

1,888

* The distribution of a dividend of €0.40 per share will be presented to shareholders’ vote at the General Meeting of 11 May 2023.

-

1.5 Comments on the Axway Software SA 2022 annual financial statements

The financial statements described below are those of Axway Software SA. They present the financial position of the parent company, strictly speaking. They do not include the financial statements of the Group’s subsidiaries, unlike the consolidated financial statements.

1.5.1 Income Statement

2022 revenue increased 8.0 % on 2021 (License -57.9%, Maintenance -8.7%, Services +17.2%, Subscription +38.7%). Revenue from non-Group customers declined 1.6% while inter-company revenue increased 17.0%.

The operating loss was -€9.1 million in 2022, compared to -€12.3 million in 2021. Despite a €7.6 million increase in purchases consumed, mainly due to inter-company billing, and a €1.8 million increase in employee costs, revenue growth (+€14.6 million) offset the increase in some expenses, improving the operating loss.

Net financial income increased from €4.1 million in 2021 to €10.9 million in 2022. The main movements in this heading comprised an increase in dividends received from subsidiaries of €8.8 million and an increase in financial expenses relating to loan interest and other costs of €1.3 million. A provision of €1.1 million was recognised on the equity investment in the new entity, DXchange Technologies Private Limited.

A pre-tax current profit of €1.7 million was recorded in 2022 compared to a pre-tax current loss of -€8.2 million in 2021.

-

1.7Axway Software at a glance

Company name

The Company name is Axway Software.

Place of registered office

The registered office is located at PAE Les Glaisins, 3 rue du Pré-Faucon, 74940 Annecy, France. The Company also has four secondary establishments located at Tour W 102 Terrasse Boieldieu, 92085 Paris La Defense Cedex, France and 23 rue Crepet, 69007 Lyon, as well as 23 rue Matabiau, 31000 Toulouse and 35 chemin du Vieux Chene, 38240 Meylan. The head office is located at 16220 N Scottsdale Rd. Suite 500, Scottsdale AZ 85254, USA.

Shareholders and investors website

Axway has a website dedicated to its shareholders and investors, www.investors.axway.com. The information presented on this website is not an integral part of this Universal Registration Document, unless expressly incorporated by reference.

Date of incorporation and Company term

The Company was incorporated on 28 December 2000 for a term of 99 years. The Company’s term will therefore expire on 28 December 2099 unless it is dissolved before that date or the term is extended.

Legal status and applicable legislation

Axway is a French law public limited company (société anonyme). It is therefore governed by all the texts applicable to commercial companies in France and particularly the provisions of the French Commercial Code.

Trade and Companies Register

Annecy Trade and Companies Register under number 433 977 980. APE code 5829A.

LEI

96950022O6SP7FQONJ77.

SIRET

433 977 980 00047

Corporate purpose (Extract from Article 2 of the Articles of Association)

“The Company’s purpose in France and abroad is: the publishing, sale, distribution, installation and maintenance of all types of software packages, the design and development of any software programme, the integration of any IT system, the sale of any IT systems and hardware, and the provision of any related services, training, consultancy and hosting;

the Company’s, direct or indirect involvement, by any means, in any transaction connected with its purpose by means of the incorporation of new companies, transfer of assets, subscription or purchase of securities or ownership interests, merger or otherwise, creation, purchase, leasing, lease management of any business goodwill or premises; the registration, purchase, use or disposal of any processes and patents connected with these activities;

and, in general, all industrial, commercial, financial, procedural, movable property or real-estate transactions that may be directly or indirectly related to the corporate purpose or any similar or connected purpose.”

Documents available for consultation

Axway Software’s Articles of Association, the minutes of General Meetings and the reports of the Board of Directors to the General Meetings, Statutory Auditors’ reports, the financial statements for the last three fiscal years and, more generally, all documents sent to or made available to shareholders pursuant to prevailing laws and regulations may be consulted at Tour W 102 Terrasse Boieldieu, 92085 Paris La Defense Cedex, France.

Where applicable, these documents are also accessible on Axway’s website www.investors.axway.com which notably contains regulated information published in accordance with Articles 221-1 et seq. of the AMF General Regulations.

Axway’s Ethics charter and Securities Trading Code of Conduct can also be consulted on Axway’s website at the following link:

https://investors.axway.com/en/bylaws-regulations-agreements.Fiscal year

The Company’s fiscal year commences on 1 January and ends on 31 December of each year.

-

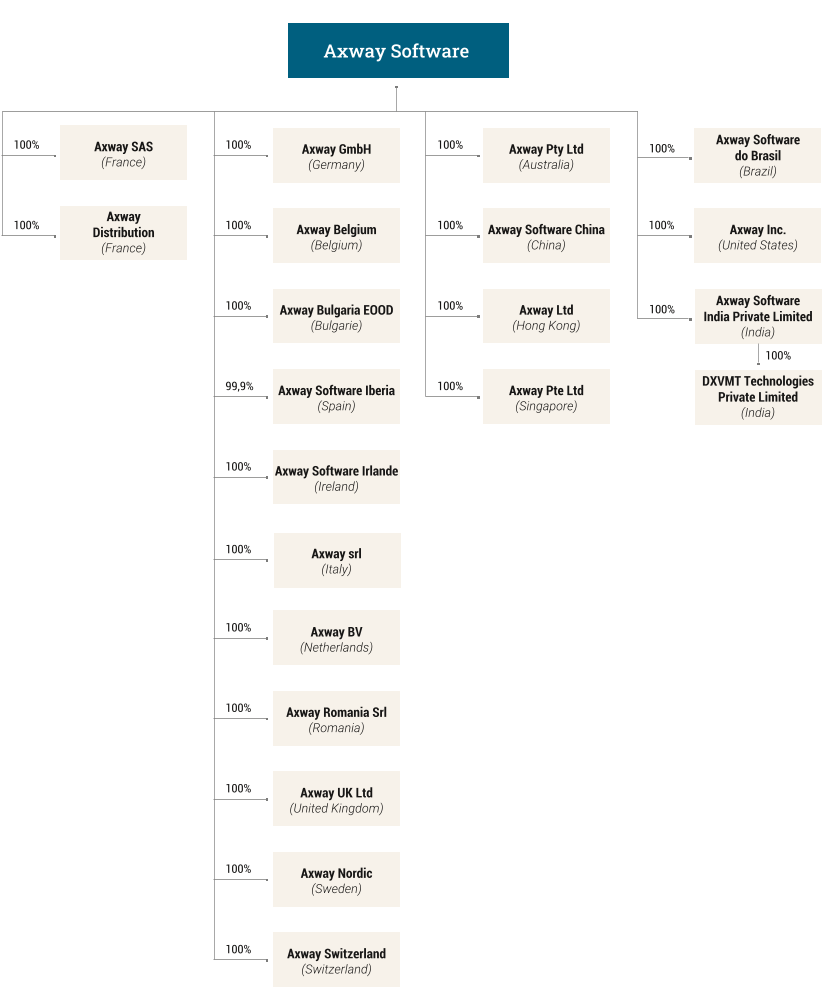

1.8Axway’s organisation

Axway’s governance structure is detailed below in accordance with Article L. 225-37-4 of the French Commercial Code. Axway’s governance structure consists of a Chairman, a Chief Executive Officer and a Board of Directors.

This organisational structure is supported by a permanent operational and functional structure as well as temporary structures for the management of particular businesses and projects.

1.8.1Permanent structure

Axway’s permanent structure comprises a management body, an organisation based on the main operating functions and functional structures.

Executive Management

The Executive Committee comprises the Chief Executive Officer, the Heads of the major operating and functional entities and the General Managers.

Executive Committee members are responsible for strategy development and supervise the organisation and management system, as well as major cross-functional initiatives.

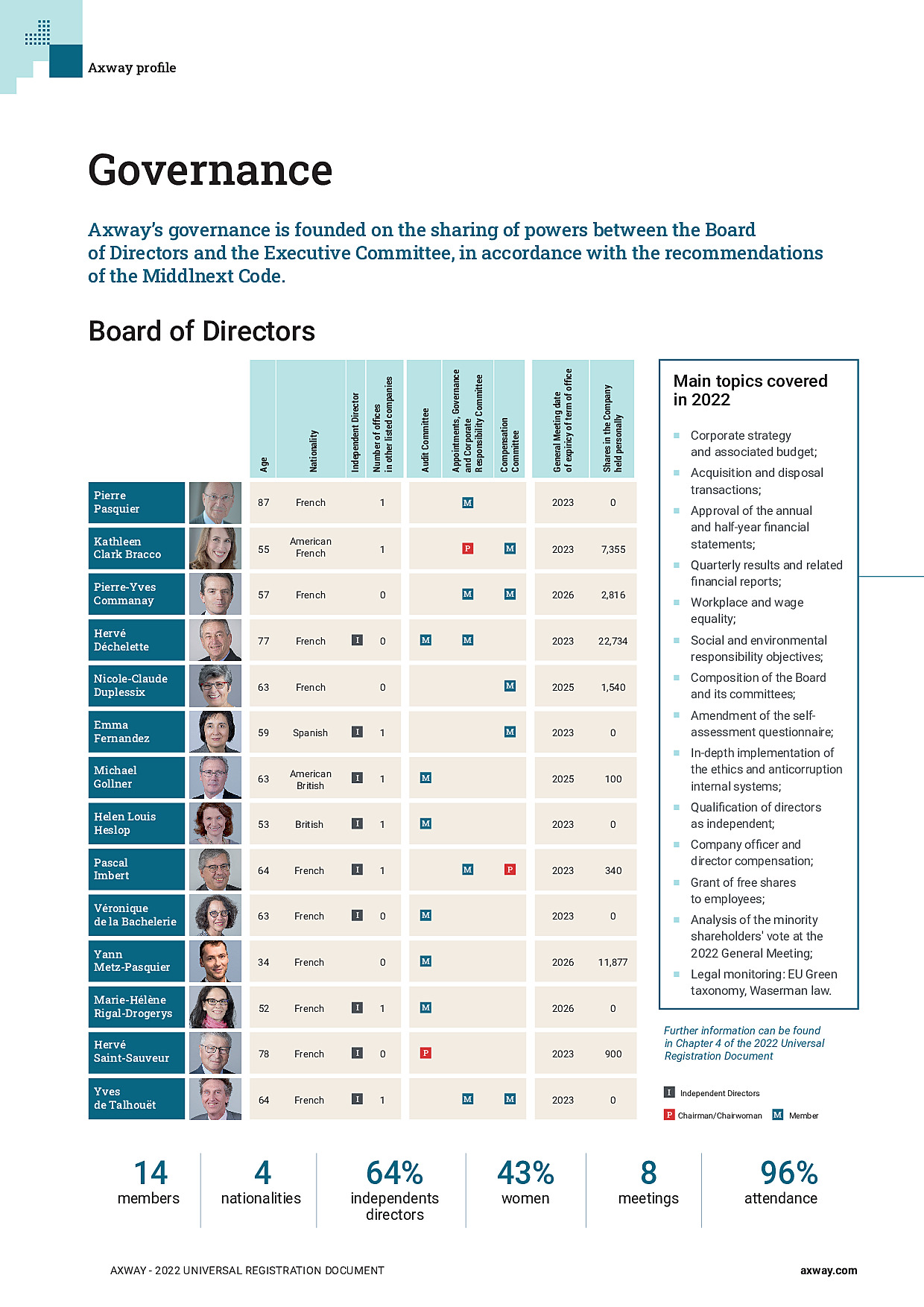

The Board of Directors

The Company’s Board of Directors is composed of 14 directors (nine of whom are independent directors). The directors elected Pierre Pasquier as Chairman at the Board meeting of 28 July 2015. Information on the Board’s organisation and working procedures is presented in Chapter 4, Section 1.2 of this Universal Registration Document.

The General Managers

The General Managers are the heads of the operating departments that make up Axway's value chain. They are involved in defining, producing and selling Axway's products and services. They comprise:

- ●Regional General Managers, responsible for all interactions with current and prospective customers in their region, including sales, pre-sales, services, customer success and field marketing. They are located in the four main regions where Axway operates: Europe, North America, Latin America and Asia Pacific;

- ●Product General Managers, responsible for all aspects of Axway’s offerings, including product management, development, innovation, maintenance and related marketing.

This structure ensures that strategies and processes are consistent and harmonised, while providing the necessary proximity to Axway customers and markets.

As part of the budget process, each of these Departments is allocated resources and assigned targets, which they are responsible for managing. Progress towards the achievement of targets is assessed on a monthly basis, with weekly control points for sales and services and monitoring of major customer accounts.

Functional structures

The Functional Departments (Corporate Secretary, Marketing, Support, Finance, Logistics, People & Culture, Communication, IT Resources, Internal Information Systems, Legal Affairs) are centralised. They contribute to overall Axway cohesiveness, ensuring commitment to Axway’s core values and serve the operational entities. They report directly to Executive Management.

The functional structures standardise the management rules (IT resources, IT systems, financial reporting, etc.) and monitor the application of policies and rules.

In this manner, they contribute to overall supervision and enable the operating entities to focus on business.

Axway’s corporate social responsibility structure

In support of its stakeholder responsibility policy and in accordance with the recommendations of the Middlenext Code of Corporate Governance updated in 2021, Axway strengthened its corporate, social and environmental responsibility (CSR) framework within its governance bodies and internal teams.

- ●CSR is included on the agenda of the Appointments, Ethics and Governance Committee, renamed the Appointments, Governance and Corporate Responsibility Committee.

- ●the Chief Executive Officer leads the CSR policy and defines the roadmap in quarterly Committee meetings with the Human Resources Director, Head of Investor Relations, the CSR Coordinator and, if necessary, the heads of the Functional Departments concerned;

- ●the main social, societal and environmental indicators are included and measured as part of the Company's performance monitoring.

- ●the CSR team is led by the Head of Investor Relations, who coordinates the work with the Functional Departments involved (Human Resources, Purchasing, IT, Legal, etc.);

- ●the network of correspondents present locally in Axway’s subsidiaries and responsible for gathering social, societal and environmental data in line with the CSR roadmap.

-

1.9Recent developments

On 26 January 2023, Axway issued a press release announcing the upward revision of 2022 annual targets:

“Paris, 26 January 2023 – Axway today announces an upward revision of its organic growth and profitability guidance for the fiscal year ended 31 December 2022. While the Company will present its detailed annual results on 22 February 2023, as planned, current unaudited estimates indicate that the previously communicated targets for 2022 should be exceeded.

-

1.10Provisional financial calendar

Event

Date

Publication/Meeting

Publication of Q1 2023 revenue

Thursday 27 April 2023

Press release (before market opening)

General Meeting

Thursday 11 May 2023

Shareholders’ Meeting (2.30 p.m. UTC+1) - Etoile Business Center - Paris

Publication of H1 2023 results

Wednesday 26 July 2023

Press release (after market closing)

Analysts virtual conference (UTC+2)

Publication of Q3 2023 revenue

Thursday 26 October 2023

Press release (before market opening)

-

1.11Investor & shareholder contacts

Tel.: +33(0)1 47 17 24 65 / email: acarli@axway.com

Tel.: +33(0)1 47 17 22 40 / email: spodetti@axway.com

Tel.: +33(0)1 47 17 24 04 / email: randriamiadantsoa@axway.com

(1)Source: Top 250 Numeum EY 2022.(2)Gartner, Forecast: Enterprise Infrastructure Software, Worldwide, 2020-2026, 4Q22 Update, Arunasree Cheparthi, Laurie Wurster, Daniel O’Connell, Lisa Unden-Farboud, Robin Schumacher, Sharat Menon, Amarendra., Fabrizio Biscotti, Christian Canales, Shailendra Upadhyay, Tarun Rohilla, 19 December 2022. The Gartner content presented in this document (the “Gartner Content”) represents the research opinions or viewpoints published by Gartner, Inc. ("Gartner") as part of a syndicated subscription service and does not constitute statements of fact. Gartner Content speaks as of its original publication date (and not as of the date of this document) and the opinions expressed in the Gartner Content are subject to change without notice. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of the Gartner research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose(3)Gartner® Magic Quadrant™ for Full Life Cycle API Management, Shameen Pillai, Kimihiko Iijima, Mark O’Neill, John Santoro, Paul Dumas, Akash Jain, 14 November 2022.(4)The Forrester Wave™: API Management Solutions, Q3 2022, Forrester Research, Inc., 22 August 2022.(5)Gartner, How Cloud Adoption Will Increase Opex Budgets, Chris Ganly, Michael Warrilow, 20 May 2022. The Gartner content described herein (the “Gartner Content”) represents research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. ("Gartner"), and is not a representation of fact. Gartner Content speaks as of its original publication date (and not as of the date of this Universal Registration Document), and the opinions expressed in the Gartner Content are subject to change without notice. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose. -

Risks and Control

-

2.1Risk factors AFR/NFPS

Axway is exposed to risks, financial and non-financial, internal and external, which if they materialise could have a negative impact on its activities, financial results, reputation or jeopardise the achievement of its objectives. Indeed, the Company operates in a constantly changing business environment. The economic and geopolitical situation has increased uncertainty and impacted Axway’s business, by exacerbating some of the already existing risks Axway faces.

However, processes implemented by the Company allow it to identify and assess risks and take the necessary actions to minimise the adverse repercussions of this global crisis on its activity and organisation.

2.1.1Risk identification and assessment

Risk mapping is the approach allowing the identification and assessment of risks. All the activity domains in the organisation were discussed with the members of the Executive Committee and the Company’s main managers, to identify the main threats and draw up a detailed description of each corresponding risk. These were assessed based on their probability of occurrence and their potential impact on business, taking account of all mitigation measures already implemented and effective (“net risk”).

Based on this work, the most material net risks for the Company were extracted and are presented hereafter. This Section presents the main risk factors to which Axway considers it is exposed at the date of filing of this document. Explanations are provided on how each risk may affect Axway, as well as information on how this risk is managed.

Other risks, which Axway is not aware of or currently considers to be of lesser importance, may also have a negative impact. In particular, additional information is provided on sensitivity to foreign exchange rate and interest rate risks in Chapter 5 “Consolidated financial statements”.

-

2.2Internal control and risk management

2.2.1Internal control and risk management environment

Axway’s internal control and risk management system complies with prevailing laws and regulations. It is supported by the reference framework, implementation guide and recommendations published and updated by the Autorité des marchés financiers (AMF).

2.2.1.1 Internal control

According to the definition of the AMF’s reference framework, internal control is “a system set up by the Company, defined and implemented under its responsibility, which aims to ensure:

- ●compliance with laws and regulations;

- ●the application of instructions and guidelines determined by Executive Management;

- ●the proper functioning of the Company’s internal processes, particularly those intended to safeguard its assets;

- ●the reliability of financial disclosures”.

2.2.1.2 Risk management

- ●create and preserve the Company’s value, assets and reputation;

- ●safeguard decision-making and other Company processes in order to promote the achievement of objectives;

- ●promote the consistency of the actions taken with the Company’s values;

- ●unify Company employees around a common vision of the main risks and increase their awareness of risks inherent to their activity.

2.2.1.3 Implementation

All of the internal control system and risk management processes described hereunder are implemented in all entities in the scope of consolidation with the aim of reducing the risk factors to an acceptable level, helping Axway achieve its objectives and providing reasonable assurance on their implementation. In the event of a new acquisition, this company will be fully consolidated into the global internal control and risk management system.

-

2.3Preparation and processing of accounting and financial information

2.3.1Coordination of the accounting and financial function

2.3.1.1Organisation of the accounting and financial function

The responsibilities of the Finance Department mainly involve producing the separate financial statements of the Company’s subsidiaries and preparing the consolidated financial statements, management control, tax issues, sales administration, financing and cash accounting. The accounting and financial function is predominantly centralised within the Company. As previously indicated, there are a limited number of legal entities, and consequently, accounting entities, which generates operational savings and limits operating risks.

The Finance Department reports to the Company’s Executive Management. Like all entities, it contributes to the aforementioned steering system. Executive Management is closely involved in the planning and supervision process as well as in preparing the financial statements.

The Board of Directors is responsible for the regular oversight of accounting and financial information.

It reviews and approves the half-year and annual financial statements, taking account of the Statutory Auditors’ opinion.

2.3.1.2Organisation of the accounting information system

All Axway companies prepare full quarterly accounts on which the Company bases its published quarterly sales figures and interim financial statements. All of these companies are fully consolidated.

Monthly cash flow forecasts and financial statements that include operating profit are prepared for all companies. The application of rules is monitored continuously by the Finance Department, particularly regarding the application of revenue recognition and project valuation rules. The accounting methods and principles used are those presented in the notes to the consolidated financial statements, as disclosed in Chapter 5, Section 5.6 of this document, (“Notes to the consolidated financial statement”). Any changes are presented to the Audit Committee.

-

2.4Insurance and risk hedging policy

Insurance management is centralised by the Legal Department. The purpose of the insurance programme is to ensure a uniform and adapted coverage of risks for the Company and its employees, for all entities and under reasonable and optimised conditions. The scope and coverage of these various insurance programmes are reviewed annually with regard to changes in the Company’s size, its activities, the insurance market and risk assessment.

All Axway companies are insured with leading insurance firms for all risks that could impact its activity, results or assets. However, it is not inconceivable that Axway may be required to pay compensation for losses not covered by the insurance programmes put in place.

Nonetheless, it is noteworthy that, in the last three years, no major claim has been reported by any of Axway’s entities under the policies described below (or others covering the Group in the past).

Assurance

Description

Professional indemnity and operations insurance

This programme covers all Axway companies. It covers the financial impacts arising from civil and professional indemnity claims in connection with their activities, due to material or immaterial physical damage or harm caused to third parties. This policy also covers the additional costs incurred to prevent accidents or reduce their impact. The overall contractual limit is €30 million per year of insurance.

This programme is supplemented in France by an insurance for inexcusable conduct, the purpose of which is to guarantee the reimbursement of the financial losses incurred by the Company if they result from work-related accidents or occupational illness.

Cybersecurity insurance

This programme covers all Axway companies. It covers all the direct or indirect financial impacts, material and immaterial damages and operating losses relating to cybersecurity risks. The overall contractual limit is €10 million per year of insurance.

Senior executives’ and company officers’ professional indemnity insurance

This programme covers all Axway company officers, senior executives and directors. The programme covers all the financial impacts of claims made against them for any professional negligence committed during the performance of their duties. The overall contractual limit is €25 million per year of insurance. An additional $5 million was subscribed for the United States scope.

Assistance for employees on assignment

This programme covers all Axway employees, company officers, senior executives and directors. It covers accidents or illnesses arising on business trips.

Operating damage and loss insurance

Insurance programmes have been set up to cover losses and damages to property (sites, equipment, terminals, etc.) and operating losses.

-

Corporate responsibility Non‑financial performance statement AFR/NFPS

-

3.1Axway, an innovative and responsible player in the digital sector

Axway’s sector, strategy and business model

The software solutions developed by Axway help companies make the most of their IT infrastructures by securely moving, integrating or exposing their strategic data.

In 2022, Axway attained its objective of optimising its product portfolio, while generating growth and improving profitability. The Company adjusted its organisation to include General Managers for each of the four main product lines. These new leaders are responsible for defining, producing and selling the various products and services proposed by Axway. Supported by the Research & Development, Product Management and Marketing teams, they comprise the value chain in the Company’s business model.

In a competitive sector with highly innovative businesses, Axway maintains its innovation and human capital assets and its responsible values through:

- ●an organisation focused on satisfying customers, measured by the Net Promoter Score (NPS);

- ●a comprehensive portfolio of products recognised by market analysts;

- ●significant investment in Research & Development, sales and marketing;

- ●balanced governance and a shareholder structure guaranteeing an independent corporate project;

- ●constant dialogue between Executive Management and employees, supported by direct surveys;

- ●agile working methods and a harmonious and safe work environment;

- ●talent development, coordinated by a dedicated structure, Axway University;

- ●a solid financial structure;

- ●values shared with all the Company’s stakeholders;

- ●CSR indicators and programmes integrated in the Company’s policy and employee objectives.

-

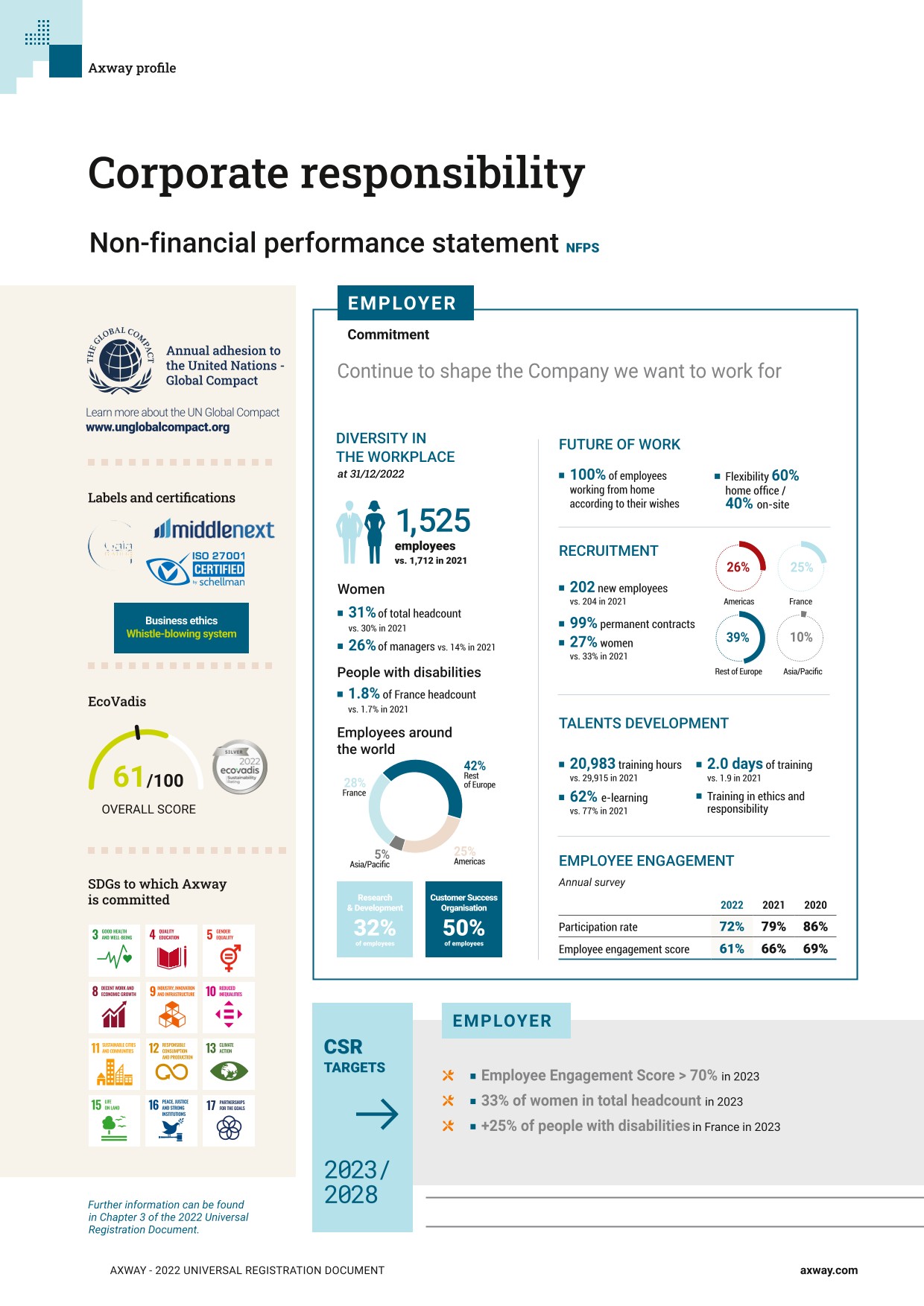

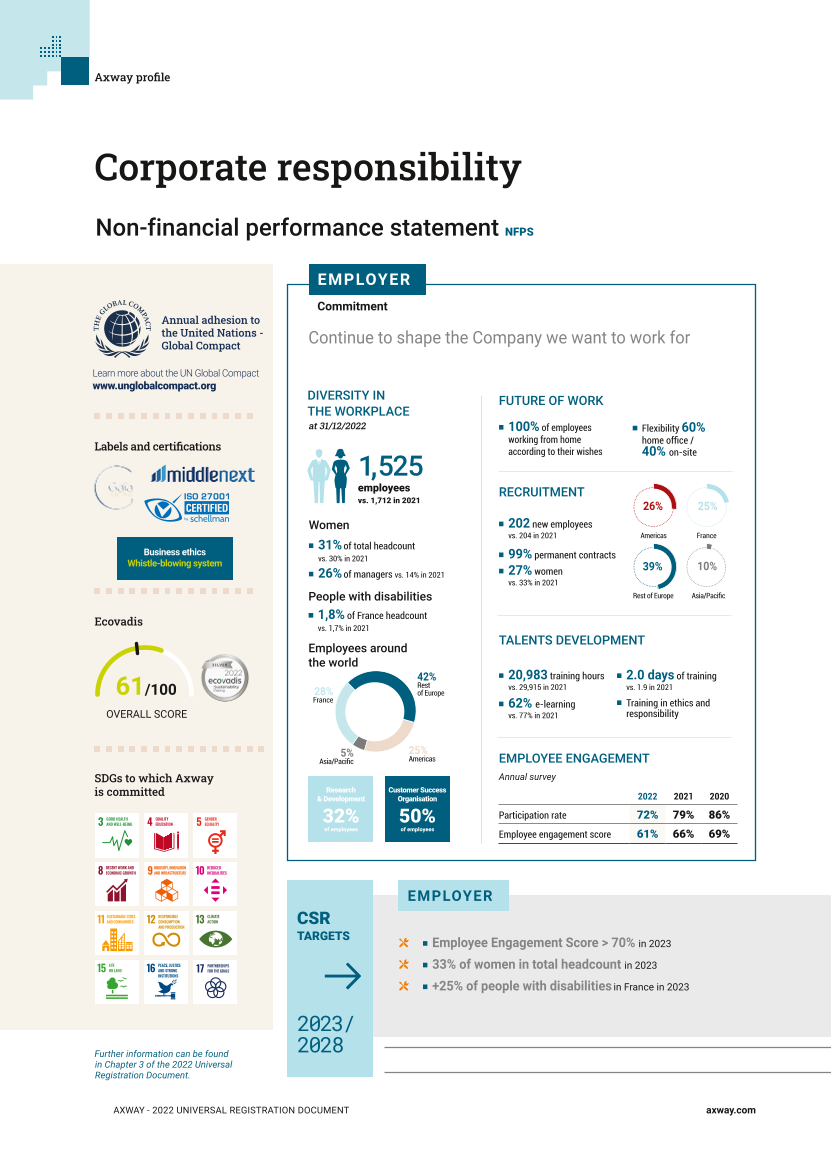

3.2Employer Commitment: continue to shape the Company we want to work for

3.2.1Progress with Employer targets

Targets set in 2021

2022 context and programme

2021 Baseline

2022 Score

2023 Target

Employee Engagement >70%

by end-2023Annual employee survey

66%

61%

>70%

33% of women in total workforce

by end-2023Strengthening recruitment and retention processes

30%

31%

33%

+25% of people with disabilities in the French workforce by end-2023

Strengthening recruitment and process for recognising disability status

1.72%

1.82%

+25%

-

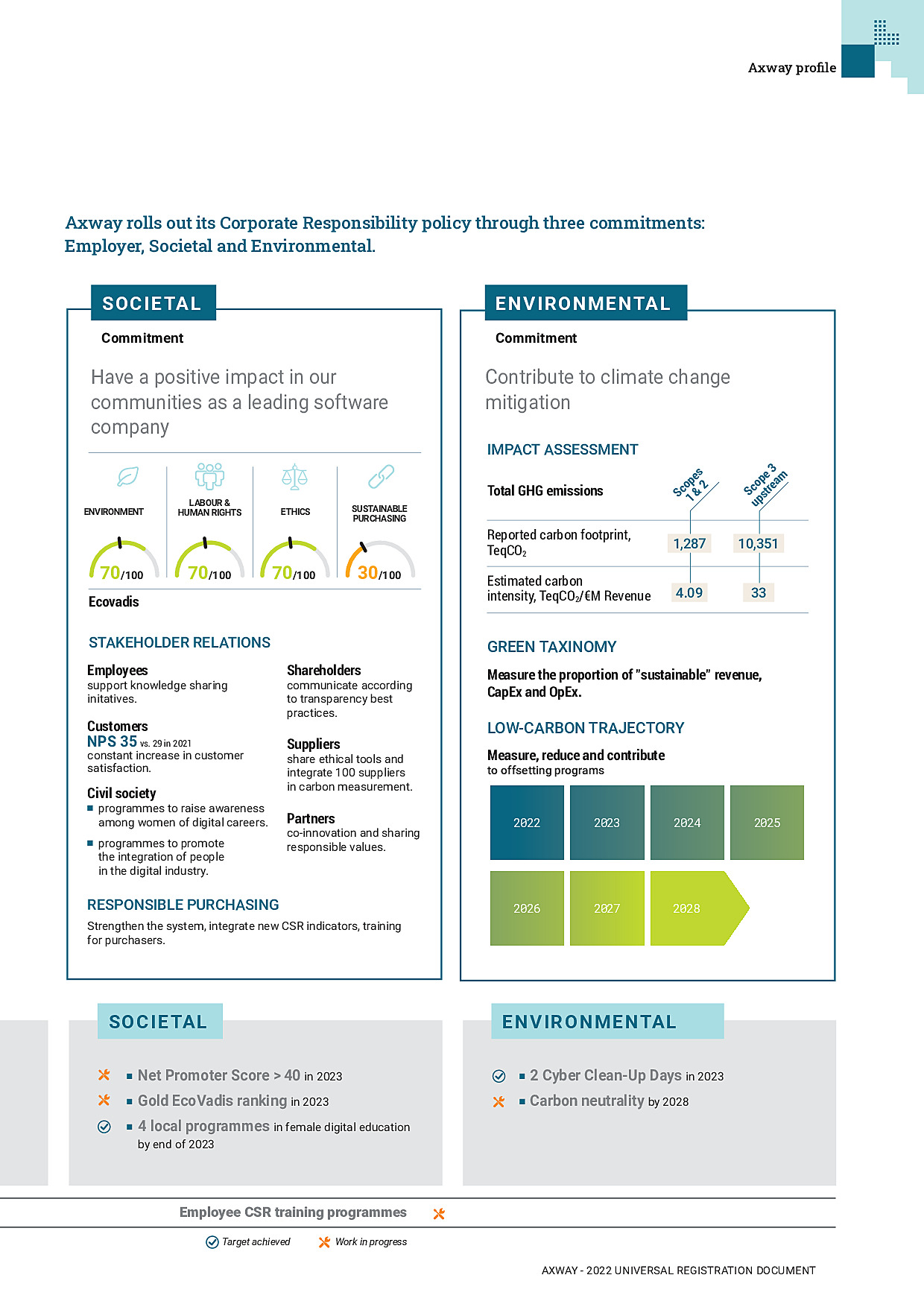

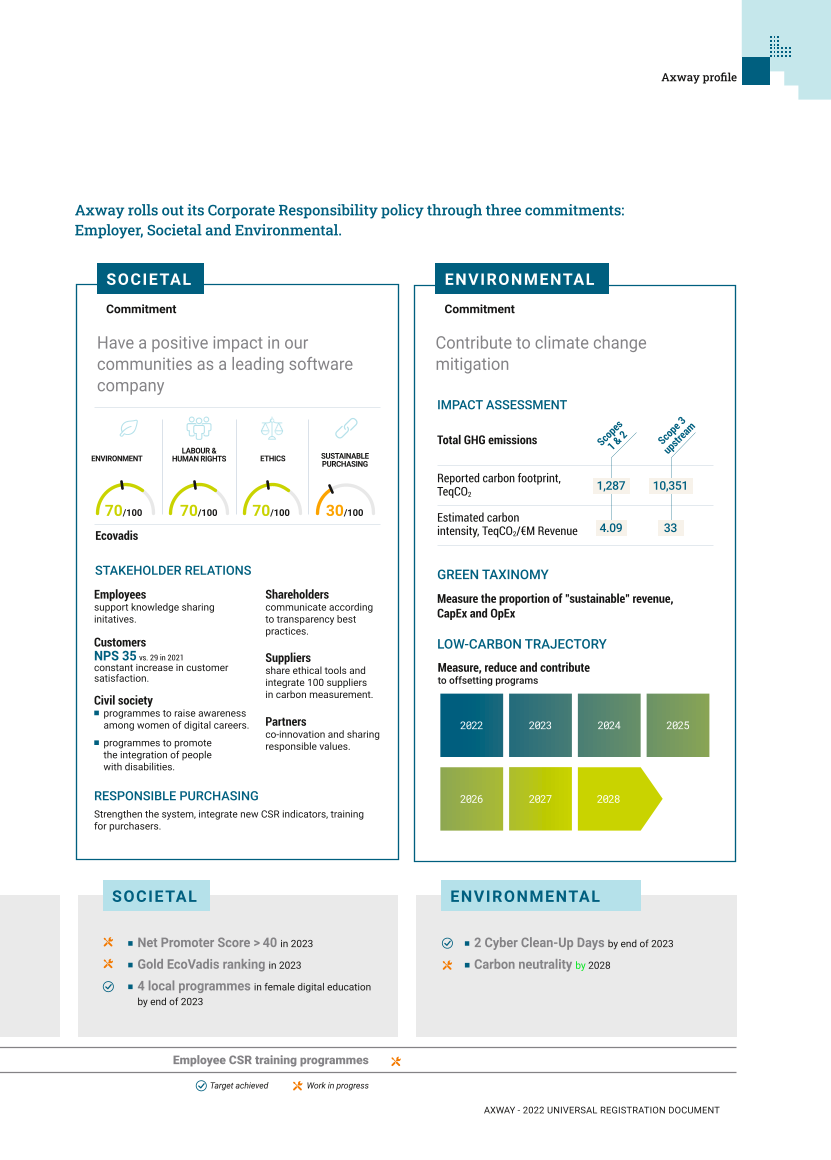

3.3 Societal Commitment: have a positive impact on our stakeholders as a leading software publisher

Axway’s CSR materiality matrix, updated every year based on surveys conducted with stakeholders, makes it possible to build programmes and deploy responsible and sustainable practices to meet the expectations of the various parties in the Company’s ecosystem. Societal programmes conducted in 2022 focused in priority on customer satisfaction and the deployment of Axway’s CSR commitments to its stakeholders and particularly its suppliers. Axway also developed its programmes promoting access to digital training and careers, through educational and social projects in line with the Employer targets described above.

3.3.1 Progress with Societal targets

Targets set in 2021

2022 context and programme

2021 Baseline

2022 Score

2023 Target

Net Promoter Score above 40 by end-2023

Continuous monitoring of customer NPS.

29

35

>40

EcoVadis Gold label by end-2023

Annual assessment by EcoVadis.

61/100

61/100

72/100

Four female digital education programmes by end-2023

Revival and activation of programmes in different countries.

Three programmes to reactivate.

Six active programmes.

Target attained and continuation of programmes.

-

3.4Environmental Commitment: contribute to climate change mitigation

For the past five years, Axway has been committed to contributing to climate change mitigation. Work conducted to produce the carbon assessment published each year has enabled the approach to be structured into three stages: the measurement, reduction and ultimately the treatment of residual emissions from Axway’s activities through offset measures.

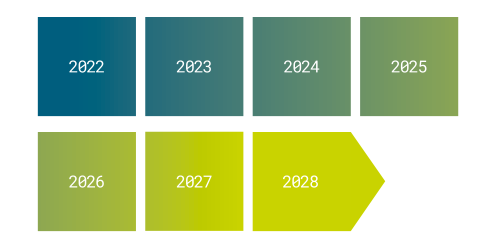

Encouraged by regulatory developments, the Company has learned much from the annual carbon assessments, which gradually strengthen the involvement of management and employees in the approach. Accordingly, at the end of 2021, under the impetus of the Chief Executive Officer, Axway embarked on a trajectory aimed at reducing its CO2 emissions as much as possible by 2028.

2022 was a new step in the implementation of this environmental commitment. Work made it possible to clarify the carbon assessment data and scopes, improve the measurement of CO2 emissions, particularly with suppliers, solicit new internal correspondents and communicate with employees to gradually initiate reduction measures.

Axway is therefore implementing a carbon system consistent with the climate targets set by the Paris Agreements, without resorting at this stage to financing third-party carbon offset, reduction or sequestration projects.

3.4.1Emission reductions

Initial roadmap for a low carbon trajectory

Axway has identified the key stages of its low carbon trajectory for the next three years, i.e. an initial horizon of 2025 which will be a major milestone. To this end, the Company has determined the necessary operational system, the tools to be developed and the skills to be acquired to achieve its objectives.

Axway also strengthened its methodology and reporting by drawing on the most reputed rating guidelines and labels. Axway therefore applies the ADEME reference guide and coefficients to calculate its carbon emissions. In 2022, the Company contributed for the first time to the Carbon Disclosure Project (CDP) and will analyse the interest of integrating SBTi guidance in 2023.

2022

2023

2024

2025

Measurement

Measurement and reduction

Measurement of scope 1 and 2 and partially 3 CO2 direct and indirect emissions from internal activities.

Inclusion of top 100 suppliers, representing 75% of total purchases, measured in CO2 equivalent ADEME monetary ratio.

Extension of the CO2 measurement scope to include scope 3 with 100% of suppliers (ADEME monetary ratio).

Comprehensive measure of all emissions for all Axway activities by gradually including the various stakeholders.

Axway global operational measurement and reduction system.

Initial analyses with a view to reducing emissions for internal activities.

Launch of reduction programmes for internal activities.

Initial analyses of the impact of Axway products used by its customers.

Continuation of reduction programmes for internal activities.

Mapping of emissions tied to Axway products and used by its customers.

Initial contributions to offset or carbon capture programmes.

Creation of a dashboard to collect data and monitor emissions.

Improve tools and dashboard for managing programmes with a view to reducing emissions.

Centralised measurement and reduction tools by activity and emission source.

Integration of environmental criteria into purchasing choices relating to Axway product development.

Sustainable purchasing: analysis of the system.

Launch of a new sustainable purchasing system and update of tools shared internally and with suppliers.

Integration of environmental indicators into contractual purchasing tools.

100% of suppliers included in the sustainable purchasing process;

Green Taxonomy: proportion of so-called “sustainable” sales, OpEx and CapEx for climate change mitigation and adaptation.

Green Taxonomy: proportion of so-called “sustainable” sales, OpEx and CapEx for the six environmental objectives.

Gradual inclusion of alignment criteria in Axway’s CapEx and OpEx investment decision process.

CDP: initial response to the simplified questionnaire based on 2021 data.

CDP: contribution to the full questionnaire.

SBTi: analyse with a view to committing to this standards base.

SBTi: progress with the project to integrate this standards base.

SBTi: progress with the project to integrate this standards base.

Internal team dedicated to the carbon programme

Changes in regulations or standard bases, particularly CSRD.

CSRD: changes in regulations or standard bases.

CSRD: changes in regulations or standard bases.

Communication with all employees.

First global Axway Cyber Clean-Up.

Employee involvement in environmental programmes.

Second cyber clean-up.

Training sessions.

Interest in creating a CSR and Low-Carbon Community internally or with certain stakeholders.

Analyses for innovation or co-innovation to reduce CO2 emissions with employees or customers.

-

Corporate governance AFR / NFPS

Axway is subject to the laws, codes and regulations prevailing in the countries where the Group operates. The Company thus complies with the various recommendations issued by the Autorité des Marches Financiers (AMF - French Financial Markets Authority) and has decided to apply the Middlenext Code of Corporate Governance.

-

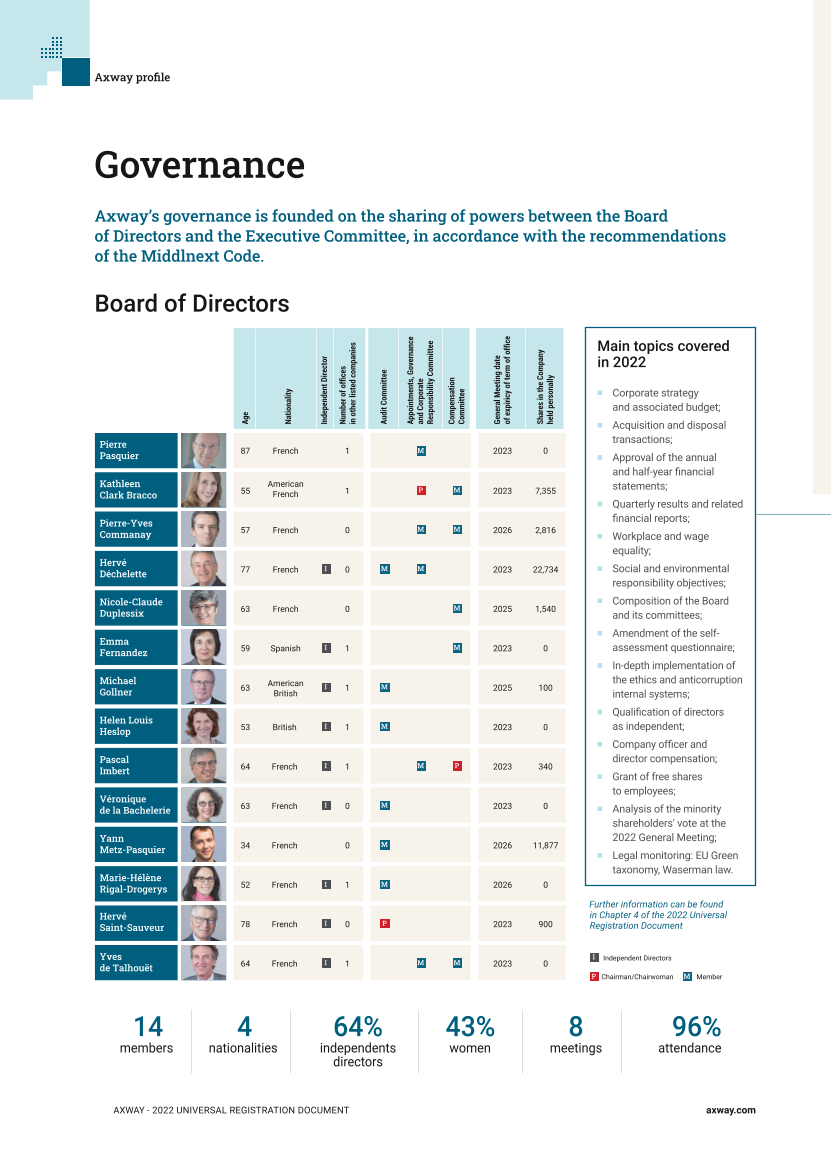

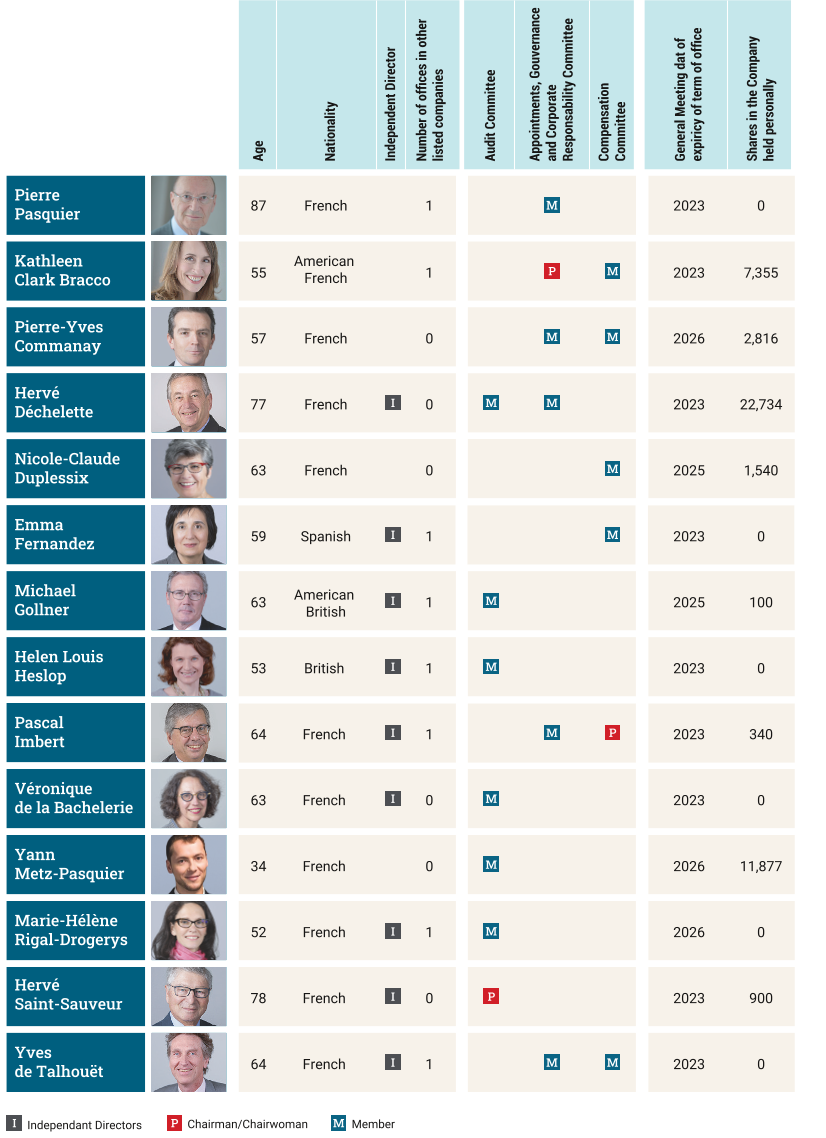

4.1Composition and procedures of the management and supervisory bodies

The Company is a public limited company (société anonyme) with a Board of Directors. It is governed by applicable French laws and regulations and its Articles of Association. The Board of Directors determines the overall business strategy of the Company, supervises its implementation and meets as often as the Company’s interests require it to do so, at the request of its Chairman.

Furthermore, on 22 June 2015, the Board of Directors decided to separate the functions of Board Chairman and Chief Executive Officer.

The main provisions of the Articles of Association(1) relating to members of the Board of Directors and management bodies can be consulted on our Investors web page at https://investors. axway.com/en/bylaws-regulations-agreements.

4.1.1Composition of the Board of Directors

The Board of Directors comprises a minimum of three and a maximum of eighteen members. During the life of the Company, the directors are appointed, reappointed or dismissed by the Ordinary General Meeting; they are all eligible for re-election. Directors are appointed for a term of four (4) years.

The Board of Directors elects a Chairman from among its members, who must be a natural person for the appointment to be valid. The Board of Directors can dismiss him at any time.

With regards to independence, the Board seeks, each year, during the review of its composition, to ensure a good balance between independent and non-independent members.

With regards to parity, the aim is to move towards an equal number of men and women. Parity is also sought in the specialist committees.

The desire for Board members of different nationalities reflects the search for multicultural diversity. Finally, a diversity of skills is also a major factor in the composition of the Board of Directors. The essential skills to guarantee the good functioning of the Board of Directors include experience in the software publishing sector, financial expertise, expertise in international environments, as well as corporate governance expertise in listed family companies, to favour the leverage of assets for profitable and sustainable growth.

Pierre Pasquier, Chairman of the Board of Directors and Director

Address:

Sopra Steria Group SA

PAE Les Glaisins

Annecy-le-Vieux

74940 Annecy

France

Date of 1st appointment:

22/12/2001

Date of most recent renewal:

General Meeting of 5 June 2019 and Board of Directors’ meeting of the same day.

Attendance rate:

Board of Directors: 100%

Appointments, Governance and Corporate Responsibility Committee: 100%

Experience

Pierre Pasquier has over 50 years’ experience in digital services and managing an international company. He founded Sopra group in 1968 with his partners and is Chairman of the Board of Directors.

A mathematics graduate from the University of Rennes, Pierre Pasquier began his career with Bull and was involved in the creation of Sogeti, before leaving to found Sopra. Recognised as a pioneer in the sector, he asserted from the outset the company’s entrepreneurial spirit, aimed at serving major customers through innovation and collective success.

Pierre Pasquier steered the deployment of Sopra in its vertical markets and internationally. The 1990 IPO, the successive growth phases and the transformational merger with the Steria group in 2014, ensured the independence of the company in a changing market.

In 2011, Pierre Pasquier led the IPO of the subsidiary Axway Software, remaining Chairman of the Board of Directors.

He was Chairman and Chief Executive Officer of Sopra group until 20 August 2012, when the duties of Chairman and Chief Executive Officer were separated.

Pierre Pasquier is also Chairman and Chief Executive Officer of Sopra GMT, the financial holding company of Sopra Steria Group and Axway Software.

Offices and duties held during the fiscal year:

In Axway

Outside Axway

- ●Director;

- ●Chairman of the Board of Directors;

- ●Director or company officer of non-French subsidiaries or sub-subsidiaries of Sopra Steria Group.

- ●Chairman of Sopra Steria Group SA;

- ●Director or company officer of non-French subsidiaries or sub-subsidiaries of Sopra Steria Group;

- ●CEO of Sopra GMT.

Offices expired during the past five years:

None.

Kathleen Clark-Bracco, Vice-Chairwoman of the Board of Directors and Director

Address:

Sopra Steria Group SA

6, avenue Kleber

75116 Paris

France

Date of 1st appointment:

28/04/2011 Director

24/10/2013 Vice-Chairwoman

Date of most recent renewal:

General Meeting of 5 June 2019 and Board of Directors’ meeting of the same day.

Attendance rate:

Board of Directors: 100%

Appointments, Governance and Corporate Responsibility Committee: 100%

Compensation Committee: 100%

Experience :

After a Master in Literature at the University of California (Irvine), Kathleen Clark Bracco began her professional career in the United States education sector. In 1998, she left Silicon Valley for France, where she joined Sopra and worked in the Communications Department. In 2002, she was appointed Director of Investor Relations, a position that she held until 2015. In this role, she forged solid ties between the Management bodies and an increasingly international range of shareholders.

Kathleen Clark Bracco was a key player in the successful spin-off of Axway. She joined the Board of Directors in 2011 and was appointed Vice-Chairman in 2013 and Chairwoman of the Appointments, Ethics and Governance Committee. She is also involved in several Group corporate initiatives, and notably initiatives focusing on fairness, the fight against corruption, ethics and employee share ownership.

In 2014, she contributed significantly to the successful merger of Sopra and Steria. In 2015, she became head of Sopra-Steria group mergers and acquisitions where she steers acquisition opportunities to complete the business portfolio in line with the strategy. This position favours the complementarity of strategies between the different Group companies.

Through these roles, her long experience in the Group and governance bodies, her knowledge of financial markets, her commitment to social and societal issues and her communications expertise, contribute to the good governance of Axway.

Enriched by her long-standing relationship with Group management, Kathleen Clark Bracco has also served as Deputy CEO of Sopra GMT since 2012.

Offices and duties held during the fiscal year:

In Axway

Outside Axway

- ●Director;

- ●Vice-Chairwoman of the Board of Directors.

- ●Permanent representative of Sopra GMT on the Board of Directors of Sopra Steria Group;

- ●Deputy CEO of Sopra GMT;

- ●Corporate Development Director Sopra Steria Group

Offices expired during the past five years:

None.

Veronique de la Bachelerie, Director

Address:

Axway Software

Tour W, 102, Terrasse Boieldieu 92085 Paris La Défense Cedex France (only in the context of her duties in Axway Software)

Date of 1st appointment:

24/02/2015

Date of most recent renewal:

General Meeting of 5 June 2019 and Board of Directors’ meeting of the same day.

Attendance rate:

Board of Directors: 88%

Audit Committee: 100%

Experience:

Veronique de la Bachelerie was appointed a director following the resignation of Françoise Mercadal Delasalles. She retired on 1 February 2023 but began her career as a financial auditor before joining the Société Générale Group in 1987, where she held various management positions in Société Générale Group financial teams. She was also CFO (Chief Financial Officer) of the retail networks of the Société Générale Group in France. From 2013 to June 2018, she was CEO (Chief Executive Officer) of the Société Générale Bank & Trust Luxembourg group and held various terms of office as director within the subsidiaries of the Société Générale Group in Luxembourg, Switzerland, Monaco and Tunisia. From June 2018 to November 2022 she managed Société Générale Consulting and Transformation, the Société Générale Group’s internal consulting department. She is a graduate of the École Supérieure de Commerce de Paris business school and is a French chartered accountant.

Offices and duties held during the fiscal year:

In Axway

Outside Axway

- ●Director.

- ●Director or company officer of Société Générale Group non-French subsidiaries;

- ●Chairwoman of the Audit Committee and member of the Investment Committee of the ESCP Foundation.

Offices expired during the past five years:

- ●Deputy Director of SGBT;

- ●Director of the Luxembourg stock exchange;

- ●President of AFCI (French Association of Internal Consultants)

- ●Director of AIMC (American Association of Internal Management Consultants);

- ●Executive Director of Société Générale Consulting and Transformation.

Pierre-Yves Commanay, Director

Address:

Axway Software

Tour W, 102, Terrasse Boieldieu 92085 Paris La Défense Cedex France (only in the context of his duties in Axway Software)

Date of 1st appointment:

06/06/2018

Date of most recent renewal:

General Meeting of 24 May 2022

Attendance rate:

Board of Directors: 88%

Compensation Committee: 100%

Appointments, Governance and Corporate Responsibility Committee: 100%

Experience :

Pierre-Yves Commanay has been a member of the Sopra Steria Group SA Executive Committee since 2009. At the beginning of April 2019, he was charged with developing consulting activities in the United Kingdom and he heads the Continental Europe division since 2011.

He has also had previous roles within the Group, which he joined in 1991. In particular, he headed the Research & Development division of a Software entity, before being appointed to develop the activities of Sopra UK as CEO of this subsidiary from 2009 to 2012. As Industrial Director of Sopra group India Pvt Ltd, Pierre-Yves Commanay was responsible for setting up the Group’s offshore platform.

Pierre-Yves Commanay is a graduate of the University of Lyon (DESS postgraduate diploma in Management) and the University of Savoie (Master’s degree in Information Technology).

Offices and duties held during the fiscal year:

In Axway

Outside Axway

- ●Director.

- ●Director of Sopra GMT.

Offices expired during the past five years:

None.

Hervé Déchelette, Director

Adress:

Axway Software

Tour W, 102, Terrasse Boieldieu 92085 Paris La Défense Cedex France (only in the context of his duties in Axway Software)

Date of 1st appointment:

28/04/2011

Date of most recent renewal:

General Meeting of 5 June 2019

Attendance rate:

Board of Directors: 100%

Audit Committee: 100%

Appointments, Governance and Corporate Responsibility Committee: 100%

Experience :

Hervé Déchelette has been with Sopra group SA for most of his career, where he was first Chief Financial Officer, before being appointed Company Secretary until 2008. He notably coordinated the financial transactions relating to the external growth of the Group’s companies.

Hervé Déchelette therefore brings to the Board of Directors his expertise in the digital services market and his financial expertise.

He is a graduate of the École Supérieure de Commerce de Paris business school and is a French chartered accountant.

Offices and duties held during the fiscal year:

In Axway

Outside Axway

- ●Director.

- ●None.

Offices expired during the past five years:

None.

Nicole-Claude Duplessix, Director

Address:

Axway Software

Tour W, 102, Terrasse Boieldieu 92085 Paris La Défense Cedex France (only in the context of her duties in Axway Software)

Date of 1st appointment:

06/06/2017

Date of most recent renewal:

General Meeting of 25 May 2021

Attendance rate:

Board of Directors: 75%

Compensation Committee: 100%

Experience :

Nicole-Claude Duplessix’s varied professional background provides a wealth of experience in IT. Nicole-Claude Duplessix started her career with the leading HR software publisher in France, ADP GSI, before joining the Sopra Steria Group. Her early work there was in HR consulting for Sopra Steria Group customers. She then supported the commitment made by Sopra Steria and its subsidiaries to its key customers in a number of industries. For seven years until the end of 2019, she was delegated by Executive Management to work on security for critical projects in complex and multicultural environments, as well as the integration of new companies acquired by the Sopra Steria Group.

With this wealth of experience in the Sopra Steria Group, Nicole-Claude Duplessix strengthens the Board’s expertise in investments and acquisitions, ethics and human resource management.

Offices and duties held during the fiscal year:

In Axway

Outside Axway

- ●Director.

- ●None.

Offices expired during the past five years:

None.

Emma Fernandez, Director

Address:

Axway Software

Tour W, 102, Terrasse Boieldieu 92085 Paris La Défense Cedex France (only in the context of her duties in Axway Software)

Date of 1st appointment:

21/06/2016

Date of most recent renewal:

General Meeting of 5 June 2019

Attendance rate:

Board of Directors: 100%

Compensation Committee: 100%

Experience :

Emma Fernandez has significant experience as a senior executive in the technology sector and particularly in ICT, security and defence, transport and traffic. She has occupied various positions during the past 25 years with Indra, in areas such as strategy, innovation and the development of new offerings, talent management, communication and product branding, public affairs, corporate governance, and corporate social and environmental responsibility, as well as mergers and acquisitions. Currently, she advises and promotes major companies and start-ups whose core business is IT.

Emma Fernandez has an engineering degree in telecoms from the Polytechnic University of Madrid and obtained an MBA from IE.

Offices and duties held during the fiscal year:

In Axway

Outside Axway

- ●Director.

- ●Director of Metrovacesa SA;

- ●Director of Effect Consultoria y soluciones digitales SL;

- ●Director of Open Bank SA;

- ●Director of Gigas Hosting SA.

Offices expired during the past five years:

- ●Director of ASTI Mobile Robotics Group SL (16/10/2017 to 02/08/2021);

- ●Director of Grupo Ezentis SA (28/06/2016 to 26/06/2020);

- ●Director of Sopra group SA (19/01/2017 to 12/06/2018);

- ●Director of Kleinrock Advisors SL (until 2018).

Michael Gollner, Director

Address:

Axway Software

Tour W, 102, Terrasse Boieldieu 92085 Paris La Défense Cedex France (only in the context of his duties in Axway Software)

Date of 1st appointment:

24/05/2012

Date of most recent renewal:

General Meeting of 25 May 2021

Attendance rate:

Board of Directors: 100%

Audit Committee: 80%

Experience :

With an MA in international studies from the University of Pennsylvania and an MBA from the Wharton School, Michael Gollner began his career in investment banking with Marine Midland Bank from 1985 to 1987, Goldman Sachs from 1989 to 1994 and Lehman Brothers from 1994 to 1999. In 1999, he joined Citigroup Venture Capital, which later became Court Square Capital, as Managing Director Europe. He founded an investment company, Operating Capital Partners, in London in 2008. As Managing Partner, Michael Gollner accompanies the development of a portfolio of companies, most often in the technologies, media or cable sectors.

Michael Gollner founded Madison Sports Group in 2013 and was the Executive Chairman. He was also the founding shareholder of Levelset in 2012 and a director. Mr. Gollner sold his investments in these two companies in 2021.

Michael Gollner brings to the Board his Anglo-Saxon financial insight and significant investment in the operating activities of the companies he manages or assists.

Offices and duties held during the fiscal year:

In Axway

Outside Axway

- ●Director

- ●Director of Sopra Steria Group SA.

Offices expired during the past five years:

- ●Director of Levelset, Inc. (November 2021);

- ●Executive Chairman of Madison Sports Group Limited (July 2020).

Helen Louise Heslop, Director

Address:

Axway Software

Tour W, 102, Terrasse Boieldieu 92085 Paris La Défense Cedex France (only in the context of her duties in Axway Software)

Date of 1st appointment:

21/06/2016

Date of most recent renewal:

General Meeting of 5 June 2019

Attendance rate:

Board of Directors: 88%

Audit Committee: 100%

Experience :

Helen Louise Heslop has significant experience in the Finance industry, specifically in international Banking and Insurance.

In particular, she has been Chief Financial Officer of several GE Capital subsidiaries and regions in France, Thailand and Sweden and led the Aviva group European transformation project.

She is currently a director of several companies in the banking and insurance sector in the United Kingdom.

Helen Louise Heslop graduated in Economics from the University of Cambridge and is a UK Statutory Auditor.

Offices and duties held during the fiscal year:

In Axway

Outside Axway

- ●Director.

- ●Director of Hiscox Insurance Company Limited;

- ●Director of Aegon in the UK;

- ●Director of Silicon Valley Bank;

- ●Director of Wefox in Switzerland.

Offices expired during the past five years:

- ●Promontoria MMB.

Pascal Imbert, Director

Address:

Wavestone Tour Franklin

100-101, Terrasse Boieldieu 92085 Paris La Défense Cedex France

Date of 1st appointment:

28/04/2011

Date of most recent renewal:

General Meeting of 5 June 2019

Attendance rate:

Board of Directors: 100%

Compensation Committee: 100%

Appointments, Governance and Corporate Responsibility Committee: 100%

Experience :

Pascal Imbert began his career in Télésystemes’ Research & Development department in 1980, with the Orange/France Télécom subsidiary. In 1990, he co-founded the consulting firm Wavestone. Today, he continues to lead its development as Chairman and Chief Executive Officer. Wavestone is a management and information systems consulting firm, which assists major companies and institutions with their transformation when faced with competition, digital and sustainable development challenges. Wavestone has been listed on the Euronext Paris market since 2000.

Pascal Imbert is a graduate of the École Polytechnique and Télécom Paris engineering schools.

He was Chairman of Middlenext, an association representing midcaps in France, from 2010 to 2014. He teaches master classes at major engineering and management schools.

Offices and duties held during the fiscal year:

In Axway

Outside Axway

- ●Director.

- ●Chairman and Chief Executive Officer of Wavestone.

Offices expired during the past five years:

- ●None.

Yann Metz-Pasquier, Director

Address:

Axway Software

Tour W, 102, Terrasse Boieldieu 92085 Paris La Défense Cedex France (only in the context of his duties in Axway Software)

Date of 1st appointment:

06/06/2018

Date of most recent renewal:

General Meeting of 24 May 2022

Attendance rate:

Board of Directors: 100%

Audit Committee: 100%

Experience :

Yann Metz-Pasquier cofounded Upfluence, an all-in-one affiliate & influencer marketing cloud platform dedicated to eCommerce, in San Francisco (CA) in 2013. He was Chief Financial Officer from 2013 to 2016 and is still a Director of the company. In 2018, Yann Metz-Pasquier joined Sopra Banking Software as head of Corporate Development for North America.

He then served as Chief Marketing Officer from 2018 to 2022. Since 2021, Yann Metz-Pasquier has been the General Manager (Executive Vice-President) of the global business unit in charge of Digital Banking solutions at Sopra Banking Software.

Yann holds a Master of Business Administration (MBA) from Harvard Business School (May 2018). He is a Chartered Financial Analyst (CFA) and graduated in 2011 from the Catholic University of Lyon (ESDES) with a Master's in Management.

Offices and duties held during the fiscal year:

In Axway

Outside Axway

- ●Director.

- ●Director of Sopra GMT;

- ●Director of Upfluence Inc.;

- ●Board Observer at Algoan.

Offices expired during the past five years:

- ●Board Observer at Axway until 6 June 2018.

Marie Hélène Rigal-Drogerys, Director

Address:

Axway Software

Tour W, 102, Terrasse Boieldieu 92085 Paris La Défense Cedex France (only in the context of her duties in Axway Software)

Date of 1st appointment:

06/06/2018

Date of most recent renewal:

General Meeting of 24 May 2022

Attendance rate:

Board of Directors: 100%

Audit Committee: 100%

Experience :

A science graduate, Marie-Hélène Rigal-Drogerys has a good understanding of the field of higher education, research and innovation and more broadly the public sector, that she combines with an operational and executive approach to strategy and organisation.

With a PhD in Mathematics and a post-graduate diploma in theoretical physics, Marie-Hélène Rigal-Drogerys began her professional career as a research professor at the University of Montpellier, then at École Normale Supérieure (ENS) Lyon. In 1998 she joined the financial audit sector, where she worked for major clients in the manufacturing, services and public sectors.

Marie-Hélène Rigal-Drogerys then focused her career on consulting, as consultant partner at Ask-Partners. As an advisor to the Chairman of the École Normale Supérieure of Lyon, since 2009, she has accompanied, both internally and externally, companies and organisations in their transition to new models within transformation ecosystems.

She also uses her expertise in her duties as Director of Sopra Steria Group and Chairwoman of its Audit Committee and as an Expert member of the Advisory Board of IMT Mines Albi-Carmaux engineering school and as a director at Chapter Zero France, a climate forum for business directors.

Offices and duties held during the fiscal year:

In Axway

Outside Axway

- ●Director.

- ●Director of Sopra Steria Group SA;

- ●Expert member of the Advisory Board of IMT Mines Albi-Carmaux engineering school;

- ●Director of Chapter Zero France.

Offices expired during the past five years:

- ●Advisor to the Chairman - École Normale Supérieure Lyon site policy.

Hervé Saint-Sauveur, Director

Address:

Axway Software

Tour W, 102, Terrasse Boieldieu 92085 Paris La Défense Cedex France (only in the context of his duties in Axway Software)

Date of 1st appointment:

28/04/2011

Date of most recent renewal:

General Meeting of 5 June 2019

Attendance rate:

Board of Directors: 100%

Audit Committee: 100%

Experience :

Hervé Saint-Sauveur was a member of Sopra group SA’s Board of Directors from June 2003 to June 2018 where he acted as Chairman of the Audit Committee. Hervé Saint-Sauveur joined Societe Generale in 1973: first within the Economic Research Department (1973), then as Director of Financial Control (1980-1984), Managing Director of Europe Computer Systems (1985-1990), Operations Manager, Capital Markets Department (1990-1994), Group CFO and Strategy Manager and Member of the Executive Committee (1995-2002) and Adviser to the Chairman (2003-2006).

He is a graduate of both the École Polytechnique and the École Nationale de la Statistique et de I’Administration Économique engineering schools.

Offices and duties held during the fiscal year:

In Axway

Outside Axway

- ●Director.

- ●None.

Offices expired during the past five years:

- ●Director of Sopra Steria Group SA.

Yves de Talhouët, Director

Address:

Axway Software

Tour W, 102, Terrasse Boieldieu 92085 Paris La Défense Cedex France (only in the context of his duties in Axway Software)

Date of 1st appointment:

31/07/2012

Date of most recent renewal:

General Meeting of 5 June 2019

Attendance rate:

Board of Directors: 100%

Compensation Committee: 100%

Appointments, Governance and Corporate Responsibility Committee: 100%

Experience :

Yves de Talhouët has been the Chairman of Faiencerie de Gien since 2014. He was previously Chief Executive Officer of EMEA HP from May 2011 and Chairman and CEO of HP France from 2006. Prior to that, from 1997 to 2004, he was Vice-President South Europe, Middle East and Africa at Schlumberger SEMA, before two years spent at Oracle France from 2004 to 2006 as Chairman and CEO. He was also Chairman of Devotech, a company that he created.

Yves de Talhouët is a graduate of the École Polytechnique and École Nationale Supérieure des Télécommunications engineering schools and the Paris Political Science Institute.

Offices and duties held during the fiscal year:

In Axway

Outside Axway

- ●Director.

- ●Director of KWERIAN (formerly TWENGA);

- ●Director of Tinubu;

- ●Director of Sopra Steria Group SA;

- ●Chief Executive Officer of TABAG;

- ●Board Observer of Castillon;

- ●Chairman of Faïenceries de Gien (2014).

Offices expired during the past five years:

- ●CEO of EMEA HP;

- ●Director of Devoteam.

Board of Directors

4.1.1.1Family relationships

To the best of the Company’s knowledge, at the date of this Universal Registration Document, the only existing family relationships were those between:

- ●Yann Metz-Pasquier and Pierre Pasquier;

- ●Pierre-Yves Commanay and Pierre Pasquier;

- ●Yann Metz-Pasquier and Pierre-Yves Commanay.

4.1.1.2Legal information

At the date of this Universal Registration Document and to the best of the Company’s knowledge, none of the members of the Board of Directors or management have been:

- ●convicted of fraud in the past five years;

- ●declared bankrupt or placed into receivership or liquidation in the past five years;

- ●incriminated and/or issued an official public sanction by statutory or regulatory authorities in the past five years.

To the best of the Company’s knowledge, none of the company officers have been prevented by the courts from acting as a member of an issuer’s administrative, management or supervisory body or from being involved in an issuer’s management or the conduct of its business in the past five years.

4.1.1.3Conflicts of interest within administrative and management bodies

The Company maintains significant relationships for its business, control, strategy and development with Sopra GMT, the lead holding company. Pierre Pasquier is the Chairman and Chief Executive Officer of Sopra GMT and the Pasquier family holds a 68.27% interest in the share capital.

Sopra GMT controls the Company as a result of its direct and indirect holding of more than half of the Company’s share capital (55.69%) and 65.53% of its voting rights (see Chapter 7, Section 7.2). Sopra GMT therefore exercises considerable influence over the Company’s business, strategy and development.

Furthermore, a framework assistance agreement was entered into with Sopra GMT, under which Sopra GMT provides a considerable number of services involving the Axway Software strategy and the potential synergies with Sopra Steria Group (see Chapter 4, Section 4.2). Pursuant to the procedure applicable to regulated agreements, this agreement, and its extension, were submitted to the Board of Directors and the General Shareholders’ Meeting for approval prior to being signed.

To the best of the Company’s knowledge, these relationships are not liable to constitute conflicts of interest.

- ●Axway’s Board of Directors includes nine (9) independent directors, selected at its meeting held on 26 January 2023, in accordance with Recommendation No. 3 of the Middlenext Code of Corporate Governance;

- ●The directors are bound by the obligation to protect the interests of the Company and comply with the rules set out in the internal regulations of the Board of Directors and any other rules contributing to good governance as defined in the Middlenext Code of Corporate Governance (Code of Ethics for Board members). Moreover, the Board of Directors’ internal regulations stipulate in Title 7 “Ethics” that: “Any member of the Board of Directors finding himself in a situation of conflict of interest or potential conflict of Interest, due notably to the offices they hold with another company, must report this situation to the Appointments, Ethics and Governance Committee as rapidly as possible, explaining the issue encountered and detailing the reasons for the existence of the actual or potential conflict of interest. […]. The Chairman of the Board, having regard to the opinion of the Appointments, Ethics and Governance Committee, asks the relevant member of the Board of Directors not to take part In the deliberations and/or not to attend the Board of Directors’ meeting”;

- ●the members of the Board of Directors undertake to report, prior to each Board meeting and depending on the agenda, any potential conflicts of interest and to not take part in deliberations or votes on any subjects where they have a conflict of interest.

Employment contract

Supplementary

pension planIndemnities or benefits due or likely to become due on the termination of service or a change of duties

Indemnities relating to a non-compete clause

Executive officers

Yes

No

Yes

No

Yes

No

Yes

No

Pierre Pasquier

Chairman

Start of term of office:

Board of Directors meeting of 5 June 2019

End of term of office:

General Meeting convened to approve the financial statements for the year ending 31 December 2022

X

X

X

X

Patrick Donovan

Chief Executive Officer

Start of term of office: 6 April 2018

X

X

X

X

4.1.1.4Information on transactions in securities by senior executives and those persons mentioned in Article L. 621-18-2 of the French Monetary and Financial Code

Pursuant to Article 223-26 of the AMF General Regulations, the following transactions involving Axway shares fell within the scope of Article L. 621-18-2 of the French Monetary and Financial Code during the fiscal year ended 31 December 2022:

Category(1)

Name

Position

Transaction type(2)

Transaction date

Number of securities

Unit price

Transaction amount

Chief Executive Officer

Patrick Martin Donovan

CEO

D

28/07/2022

23,729

€18.50

€438,986,50

(1) Category a. Members of the Board of Directors, Chief Executive Officer, Sole Executive Officer, Managing Director.

(2) Transaction type: A. Acquisition; D. Disposal; S. Subscription; E. Exchange.

-

4.2Regulated agreements and assessment of everyday agreements

4.2.1Agreements approved in previous years which had continuing effect during the year

The sole agreement approved in previous years with continuing effect during the year ended 31 December 2022 is described below:

Agreement between Axway Software and Sopra GMT

The support agreement between Sopra GMT on the one hand, and the Company and Sopra Steria Group SA on the other, defines Sopra GMT’s role as the financial holding company for these two companies. This agreement, which was initially entered into on 1 July 2011, for a period of two (2) years and then renewed in July 2013, has been amended to make it an open-ended agreement, which may be cancelled by giving twelve (12) months prior notice, in writing. This agreement aims to improve strategic planning and general policy coordination between the Sopra Steria Group and the Company, in particular, by developing synergies subsequent to the spin-off of Axway Software, as well as providing the Company with support and consultancy services.

-

4.3Code of Corporate Governance

The Company decided to adopt the recommendations of the Middlenext Code of Corporate Governance for small and midcaps updated in September 2021 (available on the Middlenext website: www.middlenext.com), due to its compatibility with the size of the Company and its capital structure.

A summary table of directors qualified as independent under the criteria used by the Middlenext Code is presented in Chapter 4, Section 4.1.

The Company applies the majority of recommendations included in the Middlenext Code and intends to adapt its internal process on a gradual basis with each passing fiscal year. However, for the fiscal year ended 31 December 2022, the application status of the Code’s recommendations is as follows:

Purpose of the recommendation

Applied

1

Board member ethical requirements

Yes

2

Conflicts of interest

Yes

3

Composition of the Board - Independent directors

Yes

4

Board member information

Yes

5

Board member training

Yes*

6

Organisation of Board and Committee meetings

Yes

7

Creation of Committees

Yes

8

Introduction of a CSR special committee

Yes

9

Introduction of Board internal regulations

Yes

10

Selection of directors

Yes

11

Term of office of Members of the Board

Yes

12

Directors’ compensation

Yes

13

Introduction of an assessment of the Board’s work

Yes

14

Relations with shareholders

Yes

15

Axway diversity and equity policy

Yes

16

Definition and transparency of the compensation of executive officers

Yes

17

Preparation of succession plans for senior executives

Yes

18

Combination of employment contract and directorship

Yes

19

Severance pay

Yes

20

Supplementary pension plan

Yes

21

Stock options and free share grants

Yes

22

Watch-points

Yes

Application of recommendations

Recommendation no. 5

Following the update of the Code in 2021, directors were made aware of the need to prepare a three-year training plan and committed to doing so over the year.

The Company’s Legal Department currently monitors developments and keeps Board members and Management informed of all regulatory changes relating to corporate governance and/or impacting the Company’s activities. An annual summary of legal developments is also prepared, highlighting major legislative changes during the year and their implementation and enabling expected upcoming developments to be anticipated.

From a review of the subjects covered by Middlenext in its directors training catalogue since 2021, it would appear that Axway directors and senior executives had the opportunity to raise and discuss all these subjects during Board and Committee meetings in 2021 and 2022.

With regard to specific matters relating to the Company’s activities, each new product is explained to directors by Executive Management during Board and Committee meetings.

Given the measures already implemented for directors and their experience and seniority in Axway, we indicated in 2021 that we partially complied with this recommendation.

In 2022, additional measures were implemented for Board members and management, with the provision of: